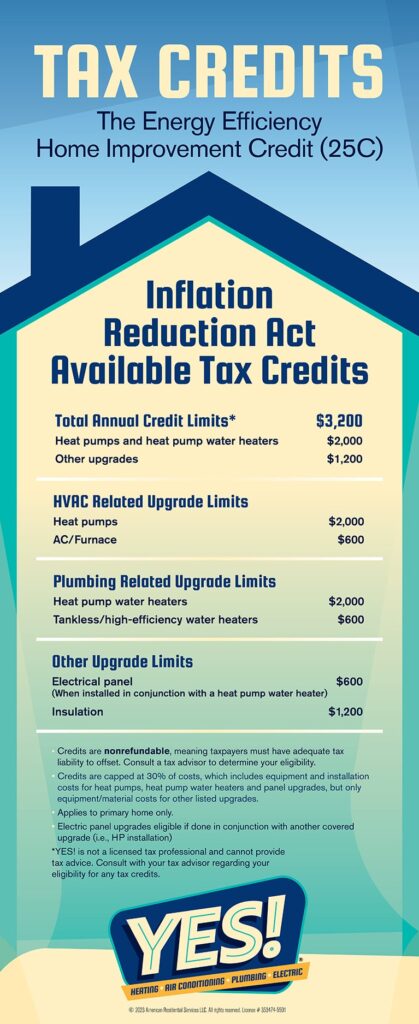

Homeowner’s Guide to Energy-Efficient Tax Credits: If you’re a homeowner in the USA, energy-efficient tax credits are your golden ticket to saving money while making your home greener and more comfortable. These credits can cover up to 30% of the cost for upgrades like new windows, insulation, HVAC systems, and even solar panels. The best part? You can claim up to $3,200 in credits per year for energy-efficient improvements, and there’s no cap for clean energy systems like solar and wind—just make sure you act before December 31, 2025.

Table of Contents

Homeowner’s Guide to Energy-Efficient Tax Credits

Energy-efficient tax credits are a fantastic way for homeowners to save money and make their homes more comfortable and eco-friendly. By upgrading your windows, insulation, HVAC systems, or going solar, you can claim significant credits and lower your utility bills. Just remember to keep your receipts, fill out IRS Form 5695, and get your upgrades done before December 31, 2025.

| What You Need to Know | Details |

|---|---|

| Maximum Credit (2025) | Up to $3,200 per year for energy-efficient upgrades |

| Clean Energy Credit | 30% of cost for solar, wind, geothermal, battery storage |

| Eligible Upgrades | Windows, insulation, HVAC, water heaters, solar panels |

| Deadline | December 31, 2025 |

| How to Claim | File IRS Form 5695 with your tax return |

| State Incentives | Many states offer additional rebates and credits |

What Are Energy-Efficient Tax Credits?

Energy-efficient tax credits are government incentives that reward homeowners for making their homes more energy efficient. These credits can cover a chunk of the cost for things like new windows, insulation, solar panels, and more. The idea is simple: if you invest in upgrades that save energy, Uncle Sam will help you pay for it.

Why Should You Care?

- Save Money: These credits can save you hundreds or even thousands of dollars.

- Lower Bills: Energy-efficient upgrades mean lower utility bills.

- Help the Planet: Using less energy means less pollution and a healthier environment.

Energy-efficient tax credits are not just a one-time deal—they’re part of a long-term strategy to help American families cut costs and reduce their carbon footprint. The Inflation Reduction Act of 2022 made these credits more generous and accessible than ever before, and the program is set to continue through 2025.

What Qualifies for the Credit?

Not every home improvement qualifies for the energy-efficient tax credit. Here’s a detailed list of upgrades that do:

Windows, Doors, and Skylights

If you install ENERGY STAR certified windows, doors, or skylights, you can claim up to $600 in credits. These products are designed to keep your home warm in the winter and cool in the summer, which means you’ll use less energy. The credit covers up to 30% of the cost, and you can claim it every year as long as you make qualifying improvements.

Insulation and Air Sealing

Upgrading your insulation or sealing air leaks can earn you up to $1,600 in credits. This is a no-brainer if you want to keep your home comfortable and your bills low. The credit covers 30% of the cost for insulation materials and air sealing systems, and there’s no lifetime limit.

HVAC Systems

If you install a new central air conditioner, furnace, or boiler, you can claim up to $600. For heat pumps and heat pump water heaters, the credit goes up to $2,000. The credit covers 30% of the cost for these systems, and you can claim it every year as long as you make qualifying improvements.

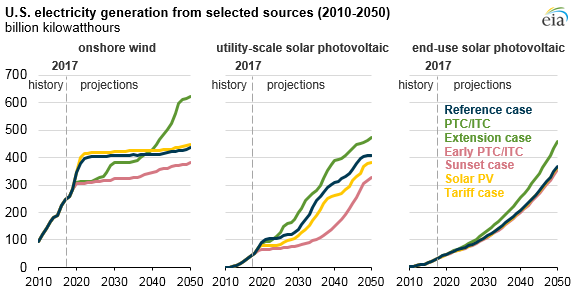

Solar Panels and Other Clean Energy

If you go solar, you can claim 30% of the cost of your solar panel system, with no cap. This also applies to wind turbines, geothermal heat pumps, and battery storage systems. The credit covers 30% of the cost for these systems, and there’s no annual or lifetime limit.

How to Claim the Energy-Efficient Tax Credits?

Claiming the energy-efficient tax credit is easier than you might think. Here’s a step-by-step guide:

Step 1: Make the Upgrade

First, make sure your upgrade qualifies. Check the official IRS and ENERGY STAR websites for a complete list of eligible products. The upgrade must be installed in your principal residence, and you must own the home.

Step 2: Keep Your Receipts

Save all your receipts, manufacturer certifications, and installer documentation. You’ll need these to prove your upgrade qualifies. The IRS may ask for proof, so keep everything organized and easy to find.

Step 3: Fill Out IRS Form 5695

When tax season rolls around, fill out IRS Form 5695, “Residential Energy Credits,” and attach it to your federal tax return. The form is available on the IRS website and includes detailed instructions for claiming the credit.

Step 4: File Your Return

Submit your tax return with Form 5695 attached. If you qualify, you’ll see the credit on your tax bill. The credit is non-refundable, which means it can only reduce your tax liability to zero.

Real-Life Examples

Let’s say you install new ENERGY STAR windows for $2,000. You can claim up to $600 in credits, which means you’ll only pay $1,400 out of pocket. If you also install a solar panel system for $10,000, you can claim 30% of the cost, or $3,000, in credits.

Common Mistakes to Avoid

- Missing the Deadline: The credits expire on December 31, 2025. Make sure your upgrades are completed and claimed before then.

- Incomplete Documentation: Keep all receipts, certifications, and installer paperwork. The IRS may ask for proof.

- Claiming Non-Qualifying Upgrades: Only certain products and systems qualify. Double-check the official lists before you buy.

- Forgetting State Credits: Many states offer additional rebates and credits. Check your state’s energy office for more savings.

State-Level Incentives

In addition to federal credits, many states offer their own rebates and incentives for energy-efficient upgrades. For example, California, New York, and Texas have programs that can stack on top of federal credits, making your upgrades even more affordable. Always check with your state’s energy office or visit ENERGY STAR’s state incentives page for the latest info.

Expert Tips

- Plan Ahead: Schedule your upgrades early to avoid contractor delays and ensure you meet the deadline.

- Bundle Upgrades: Combine multiple qualifying improvements in one year to maximize your credit.

- Ask About PINs: Some products require a manufacturer-issued product identification number (PIN) to qualify. Make sure you get this before you claim the credit.

- Document Everything: Keep detailed records of all purchases, installations, and certifications. This will help if the IRS ever questions your claim.

The History of Energy-Efficient Tax Credits

Energy-efficient tax credits have been around for decades, but they’ve evolved significantly. Before 2023, the credit was capped at $500 for a lifetime, and the percentage was lower for certain upgrades. The Inflation Reduction Act of 2022 changed the game, increasing the annual limit to $3,200 and extending the program through 2025.

The Residential Clean Energy Credit, which covers solar, wind, and geothermal systems, was also expanded. Now, homeowners can claim 30% of the cost for these systems, with no annual cap, and the program is set to continue through 2034.

The Impact of the Inflation Reduction Act

The Inflation Reduction Act has had a massive impact on energy-efficient tax credits. According to the U.S. Department of the Treasury, more than 3.4 million American families benefited from $8.4 billion in tax credits for clean energy and energy efficiency upgrades in 2023 alone. This is a huge increase compared to previous years, showing just how popular and effective these credits have become.

The Act also expanded eligibility for certain upgrades, such as heat pumps and biomass stoves, and made it easier for homeowners to claim credits for a wider range of improvements.

Is 0% APR HVAC Financing “Too Good to Be True”? A Financial Deep Dive

A Homeowner’s Guide to HVAC Financing: The Pros and Cons of Your Options

Repair vs. Replace: A Financial Breakdown of an Aging AC Unit