Personal Loan vs. Home Equity Loan: Looking to spruce up your home but unsure how to pay for it? Whether you’re thinking about a kitchen overhaul, adding a new room, or fixing that old leaky roof, choosing the right way to fund your renovation project is key. Two popular options often stand out: personal loans and home equity loans, including Home Equity Lines of Credit (HELOCs). This article gives you a deep dive into both options, shining a light on the pros, cons, costs, risks, and practical advice to help you make the smartest financial move.

Table of Contents

Personal Loan vs. Home Equity Loan

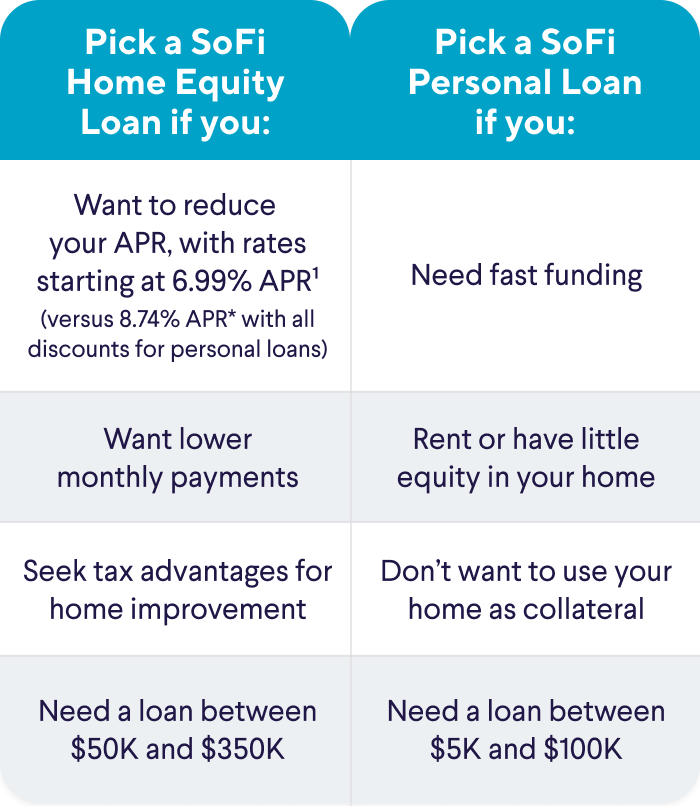

Finding the smartest way to fund your renovation hinges on your project size, finances, and risk tolerance. Personal loans provide speed and ease for smaller projects with no home risk, but at higher costs. Home equity loans and HELOCs save money on interest and offer bigger borrowing power but require more patience and risk your home as collateral. Weigh your options carefully, plan your budget realistically, and pick the financing that fits your renovation—and your peace of mind.

| Aspect | Personal Loan | Home Equity Loan / HELOC |

|---|---|---|

| Interest Rate | Average 12-20%, fixed | Average HELOC ~7.8%, variable; Home equity loans fixed and generally lower than personal loans |

| Collateral | Unsecured — no home risk | Secured — uses your home as collateral |

| Borrowing Limits | Typically $5,000 to $50,000 | Typically $25,000 to $400,000+ |

| Repayment Terms | Shorter term, 2-7 years, higher monthly payments | Longer term, up to 20-30 years, lower monthly payments |

| Approval Speed | Faster, often 1-7 days | Slower, requires home appraisal, 2 weeks to 2 months |

| Risk | No direct risk to home | Risk of foreclosure if payments not made |

| Best For | Smaller or urgent projects | Larger, planned renovations |

Understanding Personal Loans: Fast and Flexible

Personal loans are unsecured loans which means they don’t require collateral. You borrow a fixed lump sum and repay it in regular monthly installments over a predetermined term—usually between 2 and 7 years. Because there’s no collateral backing the loan, lenders charge higher interest rates to offset their risk.

Advantages of Personal Loans

- Quick Approval and Funding: Personal loans can often be approved and the money disbursed within a day or two, making them excellent for urgent or smaller renovation projects.

- No Risk to Your Home: Since personal loans aren’t secured, your house isn’t at risk if you face trouble making payments.

- Fixed Interest Rates and Payments: This predictability makes budgeting easier and gives you peace of mind.

Important Drawbacks

- Higher Interest Rates: Compared to home equity loans, personal loan rates are generally higher, averaging between 12% and 20%, varying based on credit scores and lender policies. This means you pay more over the life of the loan.

- Lower Borrowing Limits: Personal loans typically max out around $50,000, which may not cover large-scale renovations.

- Shorter Terms with Higher Payments: Because repayment periods are usually only a few years, expect higher monthly payments, which can strain your monthly budget.

Personal loans are a great fit if you have good credit, need cash fast, and are tackling a smaller project like updating your bathroom or floor refinishing.

Unpacking Home Equity Loans and HELOCs: Using Your Home’s Value

If you’ve been paying your mortgage for a while, you’ve likely built up equity in your home — that’s the amount your home is worth minus what you still owe. Home equity loans and HELOCs let you borrow money against that equity, turning your home’s value into cash.

- Home Equity Loan: Offers a lump sum with a fixed interest rate and fixed monthly payment.

- HELOC: Offers a revolving credit line that works like a credit card, where you borrow what you need, repay it, and borrow again. Rates are typically variable.

Why Homeowners Choose This Route?

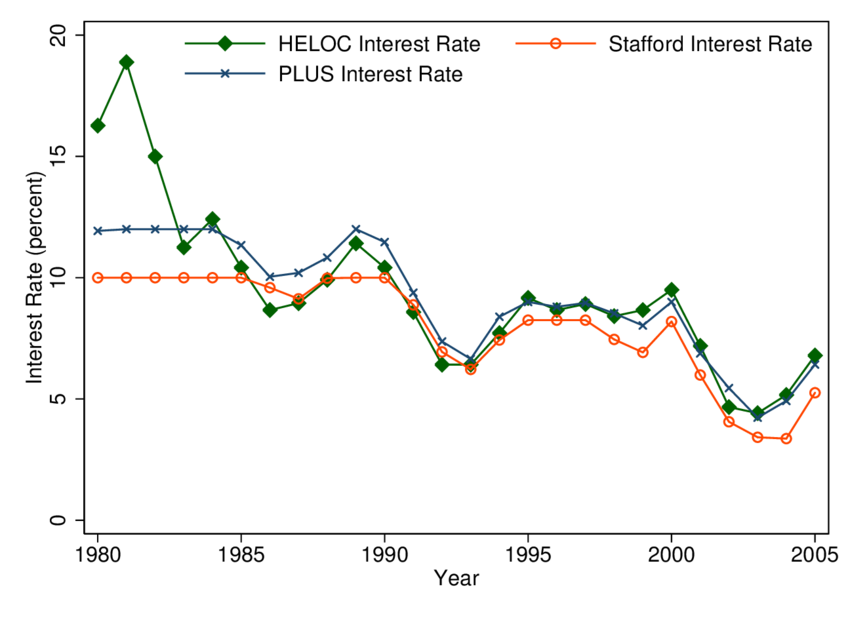

- Lower Interest Rates: Interest rates on home equity loans and HELOCs tend to be much lower, estimated around 7.8% variable for HELOCs, compared to personal loans. Fixed-rate home equity loans are usually lower than personal loans as well.

- Higher Loan Amounts: Loan sizes can be huge—depending on your equity, you might borrow $300,000 or more, which is ideal for major renovation projects.

- Tax Benefits: Interest paid may be tax-deductible if used for qualified home improvements, which can save you money come tax season (consult a tax professional for specifics).

- Long Repayment Terms: Often up to 20-30 years, this means smaller monthly payments that fit better with long-term budgets.

Risks and Considerations

- Your Home Is on the Line: Since your house serves as collateral, failing to make payments can lead to foreclosure — a serious risk.

- Variable Interest on HELOCs: If rates rise, your payments can increase significantly, affecting your finances.

- Application Process Is Longer: Requires a home appraisal, credit checks, income verification, and more paperwork—getting approved can take weeks or even months.

Home equity loans and HELOCs are perfect if you have ample equity, a well-planned renovation, and prefer lower monthly payments.

Real-World Numbers and Market Trends in 2025

- Interest Rates: Average HELOC rates are about 7.81% variable, while personal loans range from 12-20% fixed depending on credit scores and the lender.

- Borrowing Limits: Personal loans generally offer between $5,000 and $50,000; home equity loans offer up to 85% of your home’s value minus any mortgage balance, enabling borrowings potentially exceeding $100,000.

- Home Renovation Trends: About 48% of American homeowners planned renovations in 2025, with 15% using home equity products and 17% using personal loans.

Exploring Other Financing Options

While personal loans and home equity loans dominate, other routes include:

- Dedicated Home Improvement Loans: Specific to renovations with competitive interest rates and flexible tenures, offered by many banks and finance companies.

- Credit Cards: Good only for small, immediate expenses due to very high interest rates.

- Government Grants and Rebates: Especially for energy-efficient upgrades—programs vary by state, check USA.gov or Energy.gov for options.

- Savings: The best interest-free loan if you can avoid borrowing.

Choosing the Right Loan: Personal Loan vs. Home Equity Loan

1. Define Your Renovation Scope and Budget

Make a detailed estimate. Small projects under $10,000 might best fit a personal loan; larger undertakings likely require home equity financing.

2. Assess Your Financial Health

Check credit scores, income stability, and debt-to-income ratio. These impact interest rates and loan approvals.

3. Shop Around for Loan Offers

Compare rates, terms, fees, and approval times from several lenders.

4. Consider Risks, Approval Times & Flexibility

Need fast cash? Personal loans are quicker. Want lower rates and can wait? Home equity loans are better. But weigh risks of losing your home if defaulting.

5. Apply and Use Funds Responsibly

Only borrow what you need and use funds exclusively for renovation to avoid payback stress and maintain or raise your home’s value.

Expert Tips for Renovation Financing Success

- Don’t Overborrow: Stick to your renovation budget to limit debt.

- Plan for Unexpected Costs: Set aside 10–20% extra for surprises.

- Optimize Your Credit: Pay down debts and avoid new ones before applying.

- Understand Fees: Be aware of origination fees, appraisals, prepayment penalties.

- Prepay Wisely: When possible, make extra payments to save interest.

- Consult a Tax Professional: Understand tax deductions on home equity loan interest for your project.

A Homeowner’s Guide to HVAC Financing: The Pros and Cons of Your Options