Is 0% APR HVAC Financing “Too Good to Be True”?: When it comes to upgrading your home’s heating, ventilation, and air conditioning (HVAC) system, the upfront cost can be a major hurdle. That’s why 0% APR HVAC financing has become an attractive option for many Americans, promising a way to spread out payments without paying interest. But is this deal really as sweet as it sounds, or is it too good to be true? This article provides a clear, friendly, and authoritative guide to understanding 0% APR HVAC financing, breaking down the benefits, risks, financing options, and practical tips for making the smartest financial decisions.

Table of Contents

Is 0% APR HVAC Financing “Too Good to Be True”?

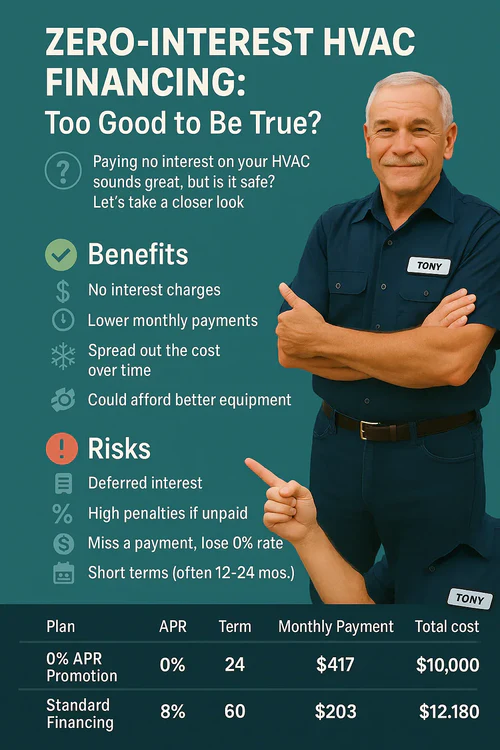

0% APR HVAC financing can be a smart and budget-friendly option to upgrade your home’s heating and cooling—if you understand what you’re signing up for. It’s not free money; you must avoid pitfalls like deferred interest, penalties, and inflated prices. By careful research, understanding terms, leveraging available rebates, and practicing good payment discipline, you can enjoy improved home comfort, increased energy savings, and solid financial peace of mind.

| Feature | Details |

|---|---|

| 0% APR Term Length | Usually 6 to 60 months, depending on lender and creditworthiness |

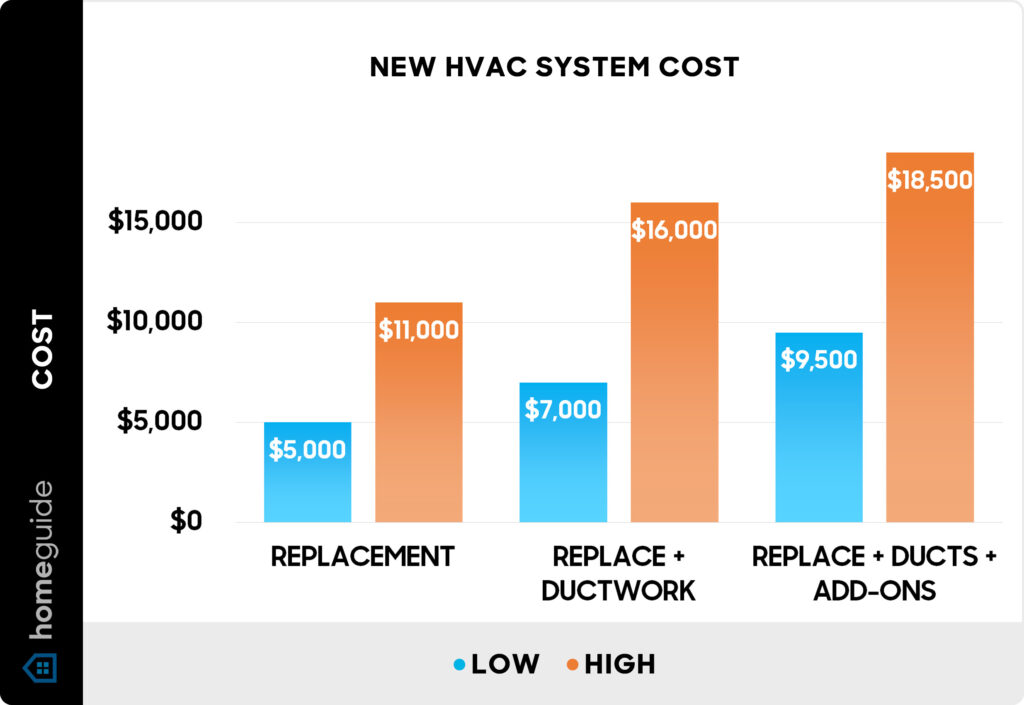

| Average HVAC System Cost | $7,500 to $15,000 depending on system type and region |

| Potential Cost with 0% Financing | Same as retail if repaid within promo period |

| Cost with High Interest Rates | Can quickly exceed $15,000 if unpaid after promo period |

| Federal Tax Credits | Up to $2,000 for heat pumps and $600 for other HVAC units under Inflation Reduction Act |

| Average HVAC System Lifespan | 15–20 years with proper maintenance |

| Energy Savings with New Systems | Energy-efficient units can lower bills by 20-40% |

What Exactly Is 0% APR Financing?

APR, or Annual Percentage Rate, is the yearly interest charged on borrowed money. When an HVAC financing plan offers a 0% APR, it means you won’t pay interest on your loan—but only for a promotional period which usually lasts between 6 and 60 months. This type of financing is often provided through partnerships between HVAC contractors and financial institutions.

This sounds like a win-win: you get to install a new HVAC system today, and you don’t pay any extra interest if you pay off the loan within the promotional period. However, this promise comes with important conditions. To retain the 0% interest benefit, you must make timely payments and fully repay the loan before the period ends. Failure to do so can lead to steep retroactive interest charges.

Understanding APR and promotional terms fully upfront can help you avoid surprises and decide if this financing suits your financial situation.

Why 0% APR HVAC Financing “Too Good to Be True”?

Spread Out Big Expenses Without Interest

For most homeowners, $7,500 to $15,000 is a hefty upfront cost. 0% APR financing turns this into manageable monthly payments over time, easing cash flow pressures, especially for family budgets or small business owners.

Energy-Efficiency and Environmental Benefits

Modern energy-efficient HVAC systems reduce both your carbon footprint and utility bills. Coupled with federal tax credits under recent legislation, such as the Inflation Reduction Act, consumers can offset upfront costs. These incentives promote environmentally sound choices while improving home comfort.

Easier Budgeting with Fixed Payments

Many 0% APR promotions offer fixed monthly payments. This predictability helps you plan budgets and avoids financial stress compared to variable-rate credit cards or payday loans. Setting up automatic payments is a smart move to maintain promotional status and avoid late fees.

Enhanced Home Value and Comfort

New HVAC systems increase property value and significantly improve air quality, noise control, and climate regulation inside your home. These qualitative benefits are often overlooked but add long-term value to your investment.

The Hidden Risks: When 0% APR HVAC Financing Can Cost You More

Price Markups to Cover Financing Costs

Some contractors inflate the HVAC system price to absorb the cost of offering 0% financing. Comparing prices between cash and financed purchases is critical to avoid unknowingly paying more.

Deferred Interest and Penalty Traps

Failing to clear your loan balance within the promotional window—or missing a payment—might trigger deferred interest. This means you could be charged interest retroactively on the full original amount, sometimes at rates as high as 30%, which can quickly balloon your costs.

Credit Score Challenges

Qualifying for 0% APR usually requires good to excellent credit scores (typically 625+). Those with fair or poor credit might face higher interest rates or be denied financing altogether.

Fees, Penalties, and Fine Print

Application fees, late payment penalties, and prepayment penalties vary by lender and plan. It’s essential to read contract terms carefully and ask questions before signing.

Long-Term Debt Commitments

Even interest-free loans still add monthly financial commitments, potentially lasting 5 years or more. Life changing events impacting income could make these payments burdensome. Responsible budgeting is key to avoiding spiraling debt.

The Lifespan Factor: How Long Will Your HVAC Last?

Understanding system lifespan helps financial planning:

| HVAC Type | Average Lifespan |

|---|---|

| Central AC | 15 to 20 years |

| Gas Furnace | 20 to 30 years |

| Heat Pump | 10 to 15 years |

| Ductless Mini-Splits | 12 to 20 years |

| Boiler | 20 to 35 years |

Proper preventive maintenance can extend lifespan and efficiency, protecting your investment and reducing the need for premature replacement financing.

Government Programs and Rebates

Energy efficiency programs provide financial relief:

- The Inflation Reduction Act offers up to $2,000 tax credit on qualifying heat pumps and $600 for other HVAC units.

- Many states and local utilities provide additional rebates, which can further reduce your final costs.

- Installing ENERGY STAR-certified products often makes you eligible for these incentives.

Comparing HVAC Financing Options in 2025

Choosing the right financing option depends on your credit, budget, and urgency. Here is a closer look at major options:

| Financing Option | Typical Interest Rates | Credit Score Needed | Approval Time | Pros | Cons |

|---|---|---|---|---|---|

| HVAC Company Financing | 0% promo to 19.5% | 625+ | Same day to 24 hrs | Convenient, tailored plans, 0% APR available | Deferred interest and fees possible |

| Personal Loans | 6% to 36% | 580-660+ | 1-7 days | Fixed payments, unsecured | Higher interest compared to promos |

| Home Equity Loans/HELOC | 7% to 15% | 620+ | 2-6 weeks | Lower interest, tax-deductible interest | Requires collateral, slower approval |

| Credit Cards | 0% intro to 25%+ | 690+ | Immediate | Flexible, immediate funding | High rates post-promo, risky for long-term use |

Many companies partner with financing institutions such as Wells Fargo to offer 0% APR with equal monthly payments for up to 60 months. Personal loans provide immediacy but can carry higher rates. Home equity financing is ideal for those with significant equity and can cover large projects but comes with risk to your home and longer processing times.

Step-by-Step Guide to Smart HVAC Financing

Step 1: Research and Compare Multiple Quotes

Get at least three quotes with itemized pricing and financing options. Verify if prices differ between cash and financed purchases.

Step 2: Understand Financing Terms Thoroughly

Ask about promotional period length, payment schedules, deferred interest clauses, fees, penalties, and early payment options.

Step 3: Review Your Credit Health

Pull your free credit report. A better score unlocks better financing options with lower risk.

Step 4: Apply for Financing

Collect your financial documents and apply through your chosen HVAC provider or lender.

Step 5: Automate Payments

Set up automatic payments to avoid accidental late fees and preserve your 0% APR status.

Step 6: Plan to Pay Off Early if Possible

Clearing the balance before the promotional period expires can save you from deferred interest costs.

Step 7: Keep Maintaining Your HVAC System

Regular maintenance increases system lifespan and efficiency, protecting your investment.

A Homeowner’s Guide to HVAC Financing: The Pros and Cons of Your Options