How to Read Your Mortgage Statement: Understanding your mortgage statement is a crucial skill for homeowners in the United States, whether you’re buying your first home or have been paying off your mortgage for years. Knowing how to read your mortgage statement helps you manage your loan effectively, avoid surprises, and make sound financial decisions. This article breaks down the key components of a mortgage statement in a clear, friendly style that’s easy for anyone—even a 10-year-old—to understand, while also providing valuable insights for professionals looking to deepen their financial literacy. Your mortgage statement is essentially a monthly report card on your home loan. It details where your money is going, how much you still owe, and the various fees and payments involved. Mortgage servicers—the companies handling your payments—send this statement regularly. Reading it carefully helps you stay on top of your loan, spot errors, and plan ahead.

Table of Contents

How to Read Your Mortgage Statement?

Reading your mortgage statement is about more than just paying a bill—it’s understanding your path to homeownership. This detailed monthly report gives you insight into where your money is going, how your loan is progressing, and how upcoming changes can impact your finances. By studying each section closely, staying proactive, and communicating with your servicer, you safeguard your investment, avoid surprises, and stay in control of one of your biggest financial commitments.

| Topic | Details |

|---|---|

| Payment Due Date & Amount | Usually monthly; includes principal, interest, taxes, and insurance |

| Loan Balance | Remaining amount owed on your mortgage |

| Interest Rate | Percentage you pay annually on your loan balance |

| Escrow Account | Holds your property taxes and insurance payments |

| Late Fees & Charges | Additional fees charged for missed or late payments |

| Contact Information | Mortgage servicer contact details for inquiries or payments |

What Is a Mortgage Statement?

A mortgage statement is the official document your mortgage servicer sends you every month (or sometimes quarterly) that summarizes your loan’s status. Think of it as a monthly snapshot showing where your mortgage stands—how much you owe, how your payment is split, and any fees or changes. Here’s what you typically find in your mortgage statement:

- Account Number: This unique ID ties your statement to your specific loan and property. Keep it handy for any correspondence.

- Payment Due Date: The exact date your mortgage payment must be received to avoid late fees.

- Payment Amount: The total you owe this period, broken down into components like principal, interest, escrow (for taxes and insurance), and any fees.

- Current Loan Balance: The amount of money still owed on your mortgage.

- Interest Rate: Shows what rate you’re being charged annually.

- Escrow Account Status: If applicable, this includes your property tax and insurance payments managed through escrow.

- Mortgage Servicer Contact Information: Essential if you need help or have questions.

By understanding the statement’s structure and details, you empower yourself to manage your home loan better.

How to Read Your Mortgage Statement: Section by Section

1. Mortgage Servicer and Account Information

Right at the top, you’ll see the mortgage servicer’s name and contact info—usually a company handling hundreds or thousands of loans. This is who you pay monthly, so having their customer service number and payment addresses is critical. Your loan or account number is also here; it’s like your mortgage’s fingerprint, making sure payments and inquiries are linked to your specific loan.

If you ever change servicers (because loans can be sold to other companies), this section alerts you to the new contact details. Keeping this information current ensures you can swiftly address any issues.

2. Payment Due Date and Amount

Your mortgage payment usually shows a due date consistent each month (e.g., the 1st, 10th, or 15th). Missing this date often means late fees, and if payments fall behind for too long, it can damage your credit.

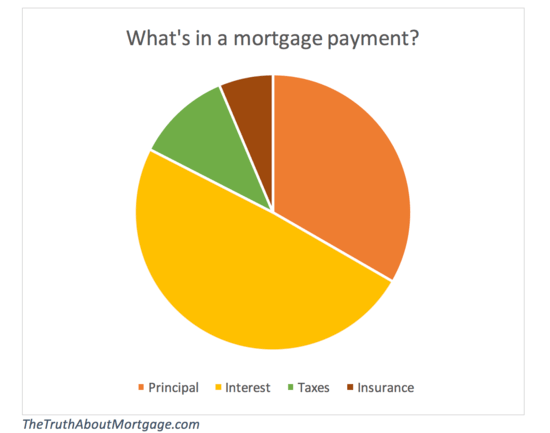

The amount due typically breaks down as follows:

- Principal: This portion reduces your loan balance—basically paying down what you borrowed.

- Interest: The cost charged for borrowing that money.

- Escrow: Funds your servicer collects to pay property taxes and insurance on your behalf.

- Fees: Any additional charges such as late fees or servicing fees.

For example, a $1,600 payment might allocate $900 to principal, $500 to interest, and $200 to escrow. This breakdown helps you understand what part of your payment grows your home equity versus the cost of borrowing or taxes.

Escrow amounts can fluctuate if your property taxes or insurance premiums change, which is why your monthly payment can sometimes increase even if your loan balance stays steady.

3. Current Loan Balance

Your statement lists the principal balance remaining—how much you still owe on the home itself. Monitoring this number shows your progress towards full ownership and growing equity.

Keeping track monthly allows you to see if your payments are being applied correctly. If your balance isn’t decreasing as expected, it might indicate an issue, such as a missed payment or inaccurate application toward principal. This is a financial red flag worth addressing promptly.

4. Interest Rate

Your mortgage interest rate is the percentage charged annually on the loan amount that hasn’t been paid. There are two main types:

- Fixed-Rate Mortgages: The rate stays the same throughout the life of the loan, offering payment consistency.

- Adjustable-Rate Mortgages (ARMs): The rate can change periodically based on market conditions.

Your mortgage statement will show your current interest rate and often note when the next adjustment is due if you have an ARM. Understanding this helps you anticipate possible increases in monthly payments.

5. Escrow Account Details

Escrow accounts are common, especially when lenders require you to prepay property taxes and insurance spread over 12 monthly payments. The servicer then uses the escrow funds to pay these bills on your behalf.

Your statement will show:

- Escrow Payment Amount: How much of your monthly payment goes toward escrow.

- Paid Out: What the servicer has paid in taxes and insurance so far.

- Escrow Balance: The current status of the escrow account; a negative balance may mean an escrow shortage, while a positive balance indicates a credit.

If your local property taxes or insurance premiums increase, your escrow payment will likely rise, causing your total monthly mortgage payment to go up accordingly.

6. Payment History and Fees

This section reviews your recent payments, showing:

- How much went toward principal, interest, and escrow.

- Whether you have any late fees or penalties.

- Year-to-date totals to understand your cumulative payments.

Consistently making on-time payments protects your credit score and avoids late fees, so use this section as a checkpoint for your payment behavior. Additionally, if you notice unexplained fees, contact your servicer right away.

7. Year-to-Date Summary

Many statements include a helpful summary showing the total amount you’ve paid toward:

- Principal

- Interest

- Escrow

This overview helps during tax season to calculate deductible mortgage interest and informs your annual budgeting.

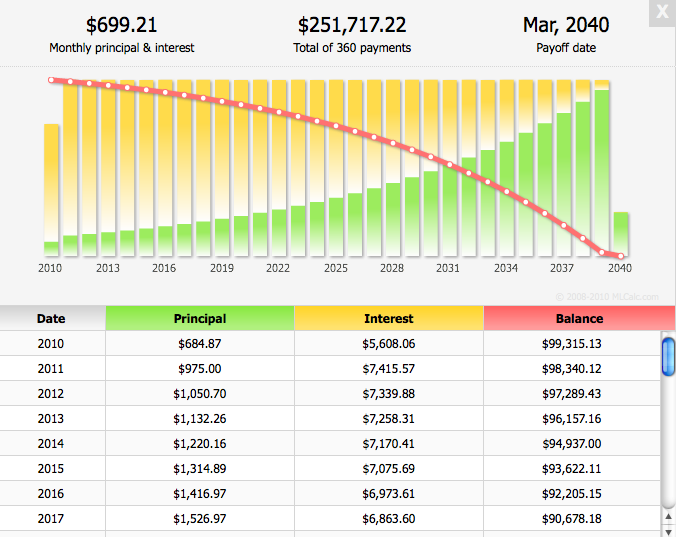

8. Loan Maturity or Payoff Date

You may see your loan’s original maturity date or an estimated payoff date. This tells you when your loan term ends based on current payments. If you’re paying extra principal, this date may move earlier, saving you money in interest.

9. Prepayment Information

This section explains whether your loan has any penalties for paying off your mortgage early or making extra payments. Many loans don’t have prepayment penalties, allowing you to reduce interest over time by paying more than the minimum.

10. Miscellaneous Notices and Messages

At the bottom or on additional pages, servicers often include important messages—for example:

- Changes in servicing company

- Adjustments in taxes or insurance

- Legal notices

- Contact info for assistance programs if you’re struggling financially

Pay attention to these notes; they may affect your payments or loan terms.

How Mortgage Payments Are Structured (PITI Explained)?

Your monthly mortgage payment typically follows the PITI formula:

- Principal: The original loan amount being paid down over time.

- Interest: What the lender charges you for borrowing the money.

- Taxes: Property taxes collected through escrow.

- Insurance: Homeowners insurance and, if applicable, mortgage insurance (PMI).

Knowing this helps you understand why your payment fluctuates. For instance, if property taxes rise, your PITI payment will increase even if principal and interest stay the same.

Why You Should Analyze Your Mortgage Statement Carefully?

Reviewing your mortgage statement each month keeps you financially healthy. It helps you:

- Catch errors or fraudulent charges early.

- Understand and manage changes to your escrow payments.

- Monitor your loan payoff progress.

- Be aware of interest rate changes on adjustable loans.

- Avoid late payments that damage your credit.

- Plan your household budget more accurately.

- Take advantage of opportunities to pay extra and reduce long-term costs.

Practical Examples: Common Changes on Mortgage Statements

Imagine your statement shows your monthly payment jumping from $1,400 to $1,600. Before worrying, review the notes or escrow section—it’s likely your property tax or insurance premium increased, which affects your escrow portion. Or, with an ARM loan, your interest rate may have reset higher. Your statement usually explains these reasons, so read it carefully.

Tips for Managing Your Mortgage Statement

- Sign up for electronic delivery for instant access.

- Review every statement, even if you use autopay.

- Save all statements for records and tax purposes.

- Contact your mortgage servicer immediately if something doesn’t look right.

- Use online mortgage calculators to model the impact of extra payments on shortening your loan term.

- Stay educated on market trends if you have an adjustable rate mortgage.

The Top 5 Home Improvements with the Best Return on Investment (ROI)

Personal Loan vs. Home Equity Loan (HELOC): What’s the Smartest Way to Fund a Renovation?

Understanding “Green Loans”: Financing for Energy-Efficient Home Upgrades