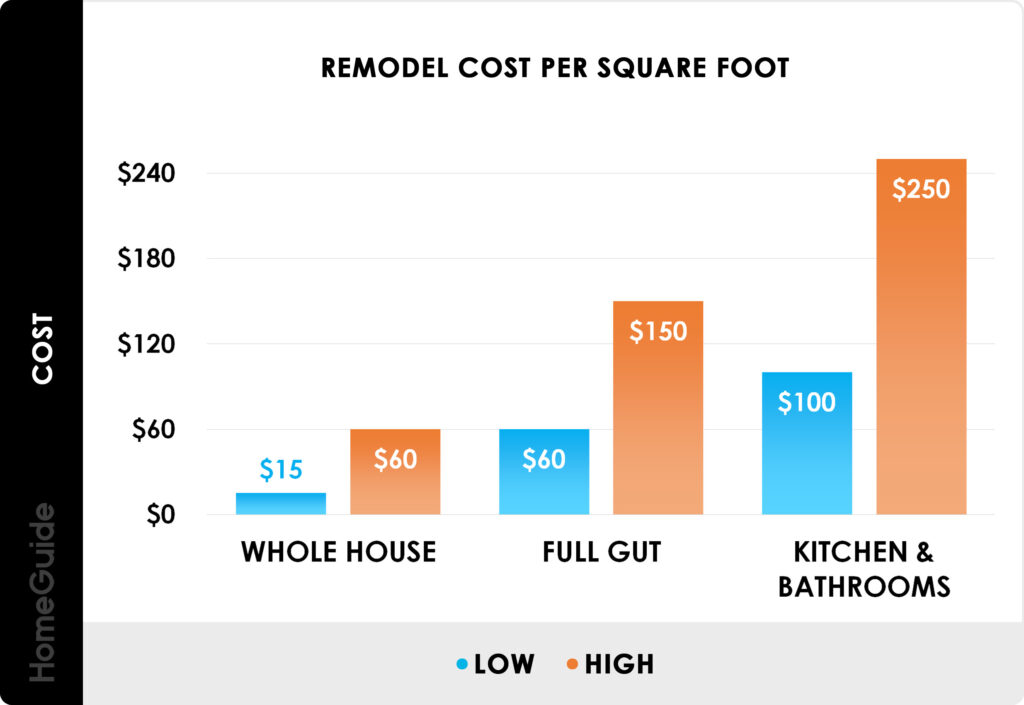

How to Create a Realistic Renovation Budget: If you’re diving into the world of fixer-uppers, trust me, you’re in for one wild, exciting ride! Creating a realistic renovation budget is the game-changer that can turn your dream project into a success story instead of a money pit. Whether you’re a first-time buyer or a seasoned pro, knowing how to plan your finances smartly will save headaches, cash, and time. So, let’s break down how to get your renovation budget nailed down—clear, simple, and straight talk, the kind of advice you wish you had before you picked up that hammer. Renovating a fixer-upper is not just about knocking down walls and picking out paint colors; it’s about planning every dollar like it’s part of a survival kit. With home renovation costs in the U.S. ranging from $15 to $150+ per square foot and average whole-home renovations running between $150,000 to $300,000, getting your budget right matters big time. Trust the hustle, but don’t get hustled by unexpected costs—those overruns sneak up faster than you think.

Table of Contents

How to Create a Realistic Renovation Budget

Creating a realistic renovation budget is your best strategy for turning a fixer-upper into a dream home without financial burnout. By carefully assessing needs, researching costs, prioritizing essentials, building in contingencies, and managing the project diligently, you control your spending and stress. Smart financing and embracing energy-efficient upgrades make your investment future-ready. Armed with this guide, you can confidently navigate your fixer-upper journey knowing that every dollar is accounted for and every challenge anticipated. Happy renovating!

| Aspect | Details |

|---|---|

| Average Renovation Cost | $15 to $150 per sq. ft., $50,000 to $300,000+ for full home renovation |

| Contingency Fund | 10-20% of total budget |

| Top Renovation Costs | Kitchen remodel ($15,000 – $45,000), Bathroom remodel ($6,000 – $18,000), Roof replacement ($7,500 – $14,000) |

| Financing Options | Renovation loans (FHA 203(k)), Home equity lines of credit, Construction loans |

| Average Household Remodel Spend | $20,000 expected in 2025; median $24,000 in 2023 (60% increase from 2020) |

| Official Resource | HUD – Renovation Loans |

What Is a Fixer-Upper and Why Budgets Matter?

A fixer-upper is a home that needs essential repairs or upgrades before it becomes fully livable or updated to your liking. The attraction? A lower price tag compared to move-in ready homes. But here’s the catch: the initial price is often just the tip of the iceberg, with renovation costs that can spiral without a solid budget in place.

Fixer-uppers often conceal underlying problems like outdated wiring, plumbing that needs upgrading, foundation issues, or inefficient insulation. These hidden costs, if unplanned, turn your budget into a sinking fund for surprise repairs. So, your renovation budget isn’t just about surface-level changes like paint and fixtures; it’s your financial safety blanket for everything from structural to cosmetic.

Costs for renovations can vary widely depending on location, home size, and project scope. A minor kitchen remodel may cost $15,000 to $45,000, while a full bathroom remodel could range from $6,000 to $18,000, but fixing major systems can push budgets much higher. Breaking down your budget by trades and materials gives you clarity and control.

Step-By-Step Guide to Create a Realistic Renovation Budget

Step 1: Assess the Scope and List Your Priorities

Walk through the property with professionals—to get an expert eye on what’s critical vs. what’s cosmetic. Your highest priority should be safety and compliance: foundation integrity, roof condition, electrical and plumbing systems, HVAC, and structural support. Cosmetic features such as flooring, paint, or landscaping come later.

Create a detailed checklist and cost estimate for each item. For example, a foundation repair may run $30,000 or more, which dwarfs $6,000 spent on new flooring. Understanding this helps avoid over-allocating funds on less critical areas at the expense of essential repairs.

Step 2: Research Local Costs & Quotes

Renovation costs fluctuate across different U.S. regions. In urban centers, higher labor and permit costs mean bigger budgets, while rural areas might save on labor but see increased material shipment charges. Consider obtaining at least three detailed bids for every major trade—from general contractors, electricians, plumbers, etc.—and always check references and licenses.

Material choice also impacts costs drastically: opting for standard-grade finishes reduces expenses, whereas luxury materials multiply them. Online tools and local home improvement stores can offer pricing insights for flooring, cabinetry, fixtures, and appliances.

Step 3: Include Permits and Fees

One budget misstep is neglecting permits, which can add 5-10% onto your bottom line. Depending on your city and project scope, permits are mandatory for structural changes, major electrical or plumbing upgrades, and additions. Failure to secure the right permits risks fines, insurance issues, and potential rework—costly in both money and time.

Step 4: Add a Contingency Fund (10-20%)

Building in a contingency fund is crucial, especially for fixer-uppers. Unseen problems crop up during demolition or system inspections—think mold, asbestos, or outdated wiring that’s unsafe. Industry insiders recommend reallocating 10-20% of your budget to contingencies to navigate these curveballs without derailing your project or taking on debt.

Step 5: Financing Your Renovation

Renovation loans are invaluable tools. The FHA 203(k) loan programs let you borrow based on your home’s enhanced value after renovations. Home Equity Lines of Credit (HELOCs) or personal loans provide flexible financing but may have varying interest rates. Research carefully to choose financing aligned with your credit profile and renovation scope.

Step 6: Track Expenses Religiously

Managing expenses requires discipline. Many renovation projects balloon due to lax spending oversight. Use budgeting apps or spreadsheets to log every payment, receipt, and invoice. Schedule weekly budget reviews with your contractor to discuss updates and prepare for upcoming expenditures.

Popular Renovation Cost Breakdown (2025 Estimates)

- Kitchen Remodel: $25,000 – $75,000. Costs vary with cabinetry, appliances, countertops, and plumbing fixtures.

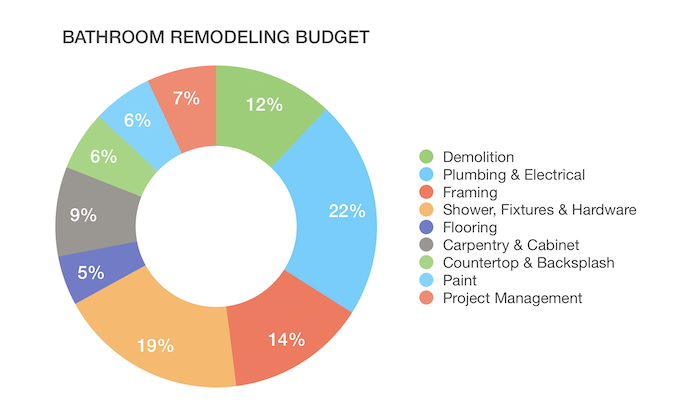

- Bathroom Remodel: $10,000 – $30,000. Includes tub/shower, fixtures, tiling, and plumbing.

- Roof Replacement: $7,500 – $14,000 depending on materials and home size.

- Plumbing Upgrades: Pipe replacement $50-$250 per linear foot; full bathroom plumbing $5,000+.

- Electrical Work: Rewiring or panel upgrades typically $5,000+.

- Flooring: Carpets $3.50-$6/sq.ft., hardwood higher.

- Structural Additions: Extensions or second floors range from $200-$500/sq.ft.

- Foundation Stabilization: $30,000-$40,000 or more for serious repairs.

Renovation Trends and Energy Efficiency in 2025

In 2025, homes are going green and smart. Energy efficiency isn’t just trendy; it’s practical given rising energy costs. Major trends include:

- Water-saving fixtures and appliances cutting consumption by over 20%.

- High-performance windows and insulation that insulate better, reduce utility bills.

- Smart HVAC systems and programmable thermostats enhancing comfort and cost savings.

- Solar panels and EV charging stations gaining government incentives that offset installation costs.

- Environmentally friendly materials that increase indoor air quality and home value.

Energy-efficient upgrades not only trim monthly bills but also boost resale value and desirability.

Managing Your Renovation Project Like a Pro

Successful renovation projects blend clear planning, communication, and oversight. Here’s how to stay in control:

- Define your project scope with measurable deliverables and set realistic timelines and budgets.

- Consider hiring a professional project manager or general contractor with a proven track record.

- Use digital project management tools to track budgets, deadlines, and milestones.

- Meet regularly with contractors and suppliers to troubleshoot problems early.

- Expect delays and challenges and build flexibility into your schedule and budget.

Well-managed projects finish on time and within budget, reducing stress and surprises.

Personal Loan vs. Home Equity Loan (HELOC): What’s the Smartest Way to Fund a Renovation?

The “Oh No!” Fund: How Much to *Really* Save for Emergency Home Repairs

Personal Loan vs. Home Equity Loan (HELOC): What’s the Smartest Way to Fund a Renovation?