How Much to *Really* Save for Emergency Home Repairs: If you’re a homeowner in the United States, the phrase “Oh No!” Fund rings true like nothing else. It’s the stash of cash set aside for those moments when your home hits a snag—a busted pipe, a dead HVAC system, or a roof leak out of nowhere. Emergency home repairs aren’t just inconvenient; they can quickly turn into financial nightmares if you’re not prepared. So, how much cash should you really set aside to handle these “oh no” moments? This article dives deep into how to establish and maintain a strong emergency home repair fund, with practical advice, expert insights, and real-world examples to guide you—whether you’re a seasoned homeowner or just getting started.

Table of Contents

How Much to *Really* Save for Emergency Home Repairs?

Establishing and nurturing an “Oh No!” Fund for emergency home repairs is one of the smartest moves every homeowner can make. With 3 out of 4 U.S. homeowners hitting unexpected home repair emergencies yearly and half lacking adequate savings, a dedicated fund between $5,000 to $10,000 or 1% to 3% of your home’s value annually can drastically reduce financial stress. Start small, be consistent, and keep your fund sacred for those “oh no” moments. With this financial armor, you’ll sleep better, stress less, and be prepared to handle whatever your home throws your way.

| Topic | Details |

|---|---|

| Percentage of homeowners facing emergency repairs | 75% (highest ever recorded) |

| Common emergency repairs | HVAC breakdowns, plumbing leaks, roof damage, electrical issues |

| Typical cost for common repairs | Burst pipe: $500, Roof replacement: $11,000, Foundation repair: $5,029 |

| Recommended emergency fund size | $5,000 to $10,000 starting, 1%-3% of home value annually |

| Government home repair programs | Loans up to $40,000, grants up to $15,000 for qualifying low-income homeowners |

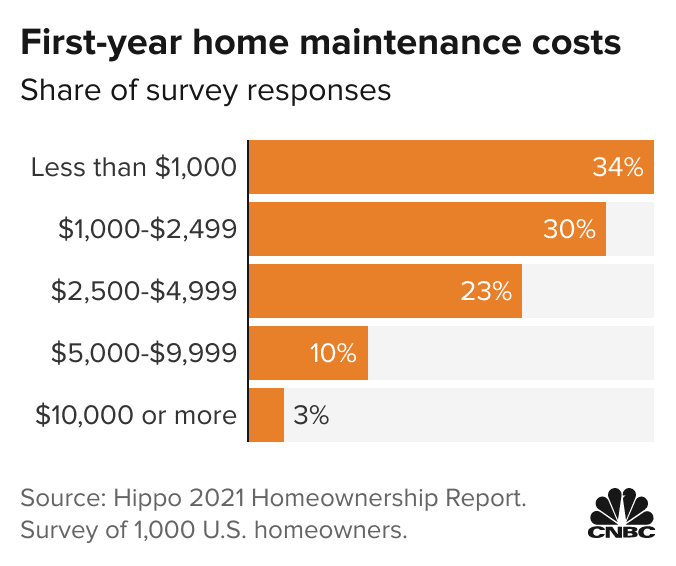

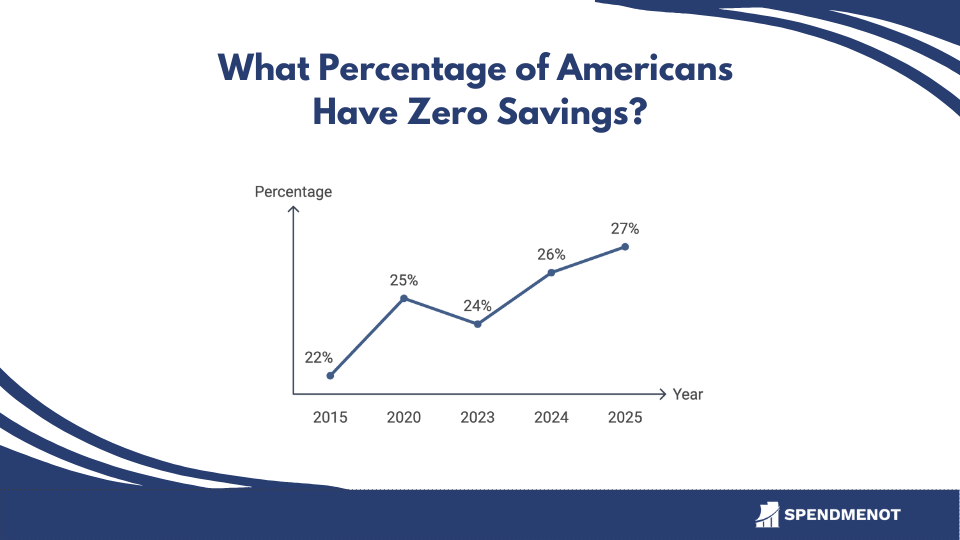

| Financial preparedness stats | 24% Americans have zero emergency savings; 60% uncomfortable with current savings |

What Is an Emergency Home Repair Fund?

Simply put, an emergency home repair fund is a dedicated pool of money solely for urgent home repairs that can’t be postponed. It’s not your renovation budget or money for cosmetic upgrades—it’s the safety net for surprise breakdowns and damages that threaten your home’s safety and comfort.

Why You Absolutely Need One?

A staggering 75% of U.S. homeowners faced at least one emergency repair in the past year, according to the 2024 HomeServe survey. Shockingly, almost half—46% of those homeowners had less than $500 saved specifically for such repairs, and 20% had no savings at all. Coupled with Bankrate’s 2025 Emergency Savings report showing 24% of American adults have zero emergency savings, that paints a grim picture of financial vulnerability. Without this fund, many frantically lean on credit cards or loans, leading to debt cycles and credit troubles.

Your emergency fund is your best weapon against unpredictability. It grants peace of mind, preserves your credit, and lets you tackle repairs promptly before minor issues spiral into major damages.

How Much to *Really* Save for Emergency Home Repairs?

You want to target setting aside at least $5,000 to $10,000 dedicated purely for home repair emergencies, more if your property is older or prone to issues. A straightforward guideline is saving 1% to 3% of your home’s current value annually for both maintenance and emergencies.

Example:

For a $300,000 home, aim to save between $3,000 and $9,000 annually. You could start by targeting the lower end and ramping up as needed. Add a buffer—say $500 to $2,000—specifically earmarked for unplanned repairs like a sudden HVAC failure or plumbing burst.

Why These Figures?

Common home repairs can cost a pretty penny:

- Burst pipe: $400 to $600 on average

- Roof replacements: $5,000 to $11,000 depending on size and materials

- Foundation repairs: often exceed $5,000, can be much higher for serious issues

The goal is to have enough cash available so you’re not forced to delay repairs or rely on high-interest credit options.

Building Your “Oh No!” Fund: Step-by-Step Guide

1. Open a Separate, Dedicated Savings Account

The first step is to separate your emergency repair fund from day-to-day checking or savings. Choose a high-yield savings account or a liquid money market account that offers security, easy access, and competitive interest.

2. Start Small but Steady

Don’t stress if you can’t stash away thousands immediately. Commit to automated monthly transfers of $50 to $100 from your paycheck. Consistency over time builds a solid cushion without feeling burdensome.

3. Turbocharge with Windfalls

Whenever you get extra cash like a tax refund, bonus, or side gig income, funnel a chunk directly into your fund. This strategy accelerates growth without denting your regular budget.

4. Reassess and Adjust Annually

Home repair costs, inflation, and the age of your house affect your fund needs. Add a 3-5% inflation buffer yearly to maintain purchasing power.

5. Protect the Fund — Don’t Dip for Non-Emergencies

Reserve emergency funds strictly for urgent repairs. Avoid the temptation to use it for upgrades or routine spending. If you must use some money, plan to replenish it quickly.

What Happens If Your Fund Isn’t Enough?

Sometimes even the best funds fall short. When that happens, explore these options:

- Home Equity Line of Credit (HELOC): Leverage your home’s equity for lower interest borrowing than credit cards.

- Homeowners Insurance: Covers certain catastrophic events (fire, severe weather), but generally excludes wear-and-tear or mechanical failures.

- Local and Federal Assistance: USDA and state programs often offer loans or grants to qualified homeowners facing repairs.

- Community Resources and Nonprofits: Some organizations assist with emergency repairs for eligible families.

- Home Warranties: Monthly plans that cover repair or replacement of home systems and appliances, useful for older homes but review limits carefully.

Don’t Forget Preventive Maintenance

One of the smartest ways to shield your fund is by staying proactive with routine maintenance. Regularly check HVAC systems, plumbing, gutters, and roofs to catch issues early and save thousands in costly repairs. Experts recommend budgeting 1-2% of your home value annually just for upkeep.

Examples:

- Monthly: Check for leaks, pipe corrosion

- Bi-annual: Inspect roofing and gutters

- Annual: Professional inspections on critical systems

Preventive care extends the life of home systems and mitigates expensive emergencies.

Inflation and Home Repair Costs: A Growing Concern

The cost of home repairs has consistently trended upward. In 2024, unexpected repair expenses doubled compared to previous years per homeowner reports. Inflation reduces the effectiveness of stagnant savings, underscoring why an annual review and top-up of your emergency fund is essential.

What About Renters?

You don’t own the property, but that doesn’t mean you’re free from household emergencies. Having $1,000 to $3,000 saved can help renters cover deductible costs, urgent fixes landlords expect tenants to handle, or temporary relocation expenses. It’s a savvy money move no matter your housing situation.

Most Common Emergency Repairs and Their Costs

| Repair Type | Average Cost (USD) | Why It Matters |

|---|---|---|

| Burst Pipes | $400 – $600 | Quick water shutoff critical |

| HVAC Repairs | $350 – $2,000 | Essential for climate control |

| Roof Repair/Replacement | $1,000 – $11,000 | Protects against weather damage |

| Foundation Repair | $2,000 – $8,000+ | Structural integrity |

| Window Replacement | ~$400 | Security and insulation |

| Mold Remediation | $1,200 – $3,700 | Health risk if untreated |

Behavioral Tips to Build and Protect Your Fund

- Track your expenses to identify saving capability.

- Treat your emergency fund like a fixed monthly bill—”pay yourself first.”

- Stay disciplined—avoid using the fund for anything but legitimate emergencies.

- Stay informed about home repair assistance programs accessible locally or federally.

Repair vs. Replace: A Financial Breakdown of an Aging AC Unit

A Homeowner’s Guide to HVAC Financing: The Pros and Cons of Your Options

Is 0% APR HVAC Financing “Too Good to Be True”? A Financial Deep Dive