Home Shouldn’t Be Your Only Retirement Plan: When thinking about retirement, your home is often front and center. It’s probably the biggest asset you own, and, as of 2024, American seniors collectively hold about $14 trillion in home equity. But here’s the harsh truth: your house shouldn’t be your only plan for retirement. While it’s a key resource, relying solely on your home exposes you to risks like market ups and downs, lack of cash flow, and ongoing costs that can drain your savings. Retirement planning is more like a long road trip than a sprint. Your home is just one stop along the way. To cruise smoothly through your golden years, you need a well-rounded, diversified plan that includes savings, investments, and steady income streams.

Table of Contents

Home Shouldn’t Be Your Only Retirement Plan

Your home is a valuable, powerful asset but not a stand-alone retirement plan. Relying exclusively on home equity creates risks of illiquidity, unexpected home costs, and market downturns. Diversifying your retirement savings with investments, accounts, and insurance creates steady income and financial peace of mind. Plan early, use home equity as a supplement, and take advantage of expert guidance and tools to build a secure and comfortable retirement.

| Topic | Details |

|---|---|

| Home Equity in Retirement | U.S. seniors hold about $14 trillion in home equity as of 2024. |

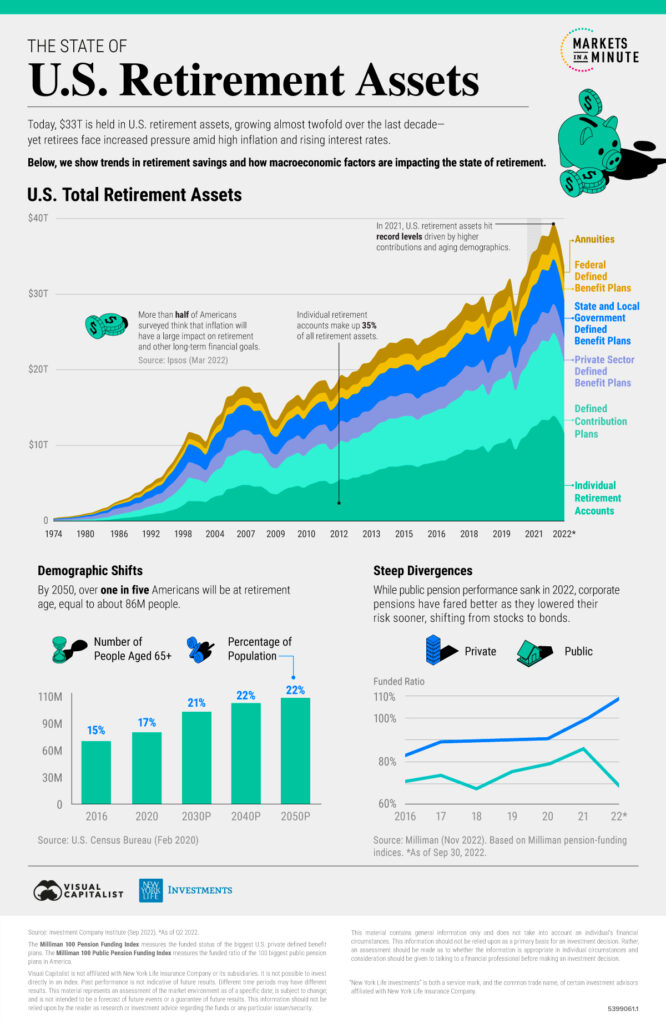

| Total U.S. Retirement Assets | Hit $45.8 trillion in mid-2025, showing how wealth is spread across various accounts and assets. |

| Risks of Solely Relying on Home Equity | Includes market fluctuations, illiquidity, ongoing home costs, and borrowing pitfalls. |

| Common Retirement Assets | 401(k)s, IRAs, stocks, bonds, annuities, emergency funds make for a diversified nest egg. |

| Inflation’s Impact | Inflation lowers buying power; diverse investments often keep pace better than home appreciation. |

| Tax Implications | Capital gains exclusions, property taxes, and tax-deferred/advantaged accounts vary widely. |

The Role of Your Home in Your Retirement Plan

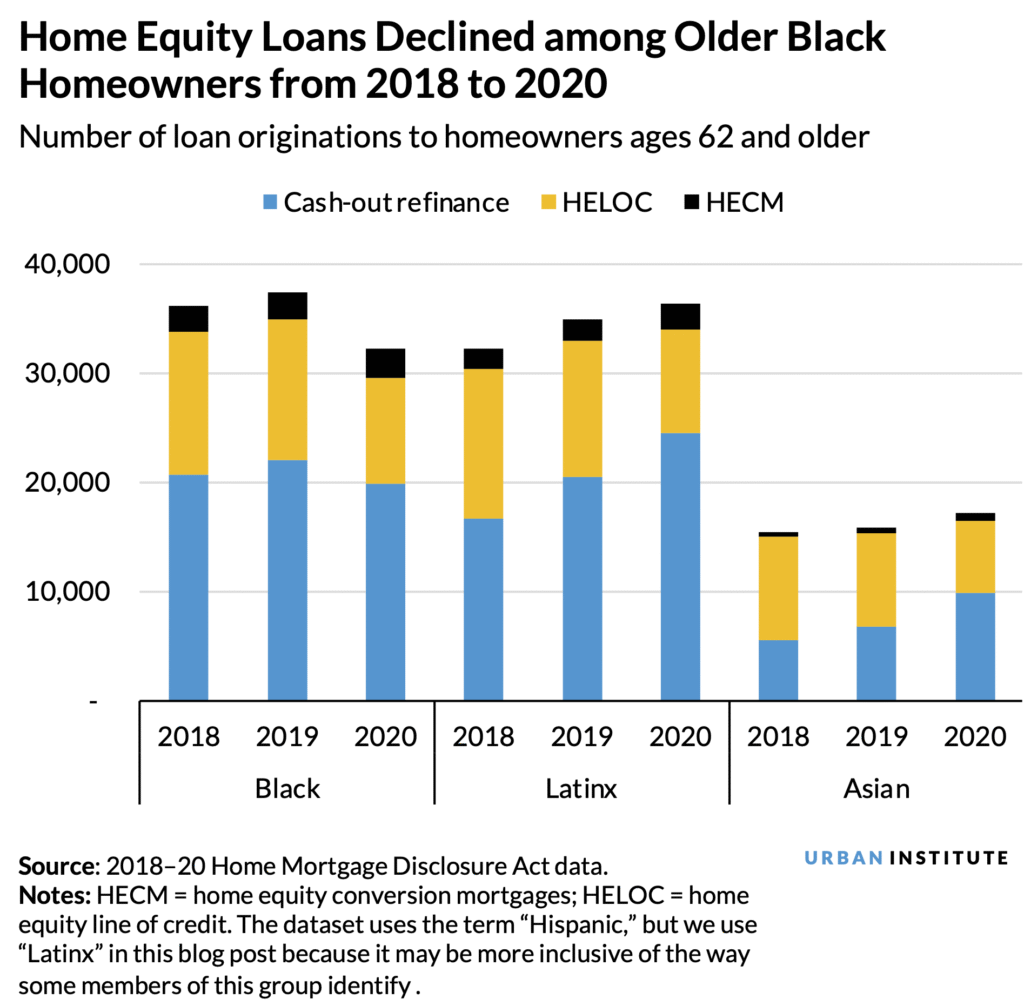

Your home is usually your largest asset. According to recent research, approximately 62+ year-old Americans have roughly $14 trillion in home equity pooled nationally, underscoring its crucial role in retirement wealth. But turning that hard-earned equity into usable income isn’t straightforward.

Why Home Shouldn’t Be Your Only Retirement Plan?

Home equity is what your home is worth minus any mortgages or loans on it. Many retirees hope to tap into this equity by selling their homes, downsizing, or using reverse mortgages. But each option comes with challenges:

- Liquidity Limitations: Unlike cash or stocks you can sell quickly, selling a home takes time and costs money—realtor fees, closing costs, and moving expenses all chip away at the cash you get.

- Market Uncertainty: Housing markets do fluctuate. The 2008 financial crisis caused home values to plunge sharply, leaving many homeowners underwater on their mortgages. If your plan assumes home values only go up, you might face a shortfall.

- Continuing Expenses: Property taxes, homeowners insurance, and maintenance costs remain even after retirement—and they tend to rise with inflation. These can erode your retirement funds if not planned for carefully.

- Borrowing Risks: Reverse mortgages or home equity lines of credit reduce the ownership stake in your home, involve fees, and may leave less to pass on to heirs.

- Emotional and Lifestyle Factors: Your home is more than an asset—it’s your sanctuary. Downsizing or relocating late in life can be emotionally difficult and impact your quality of life.

Why Diversifying Your Retirement Portfolio Matters?

Instead of depending heavily on your home, spreading your retirement savings across multiple assets reduces risk and increases potential income sources. The latest data show that as of mid-2025, total U.S. retirement assets are $45.8 trillion, including accounts like IRAs, 401(k)s, employer pensions, stocks, and bonds.

Types of Retirement Savings and Investments

- 401(k)s and Employer Plans: These tax-advantaged plans often include employer matching, making them an affordable and effective savings vehicle

- Individual Retirement Accounts (IRAs): Roth and Traditional IRAs provide tax benefits suited to different income levels and retirement strategies

- Stocks and Bonds: Equities can provide growth above inflation over the long term, while bonds offer income stability, helping balance portfolio volatility

- Annuities: These insurance products guarantee income, helping manage longevity risk and stabilize finances.

- Cash Reserves & Emergency Funds: Having liquid cash prevents forced asset sales during market downturns

- Insurance and Long-Term Care Planning: Healthcare expenses make up an increasing share of retirement spending, making early planning vital

Inflation’s Impact on Retirement Planning

Inflation in the U.S. typically hovers around 3% annually. Over decades, this gradual increase in prices erodes the spending power of fixed income from home equity or savings. While your home might gain value, rising property taxes and maintenance often outpace appreciation. Diversified investments, especially equities, have historically provided returns that outpace inflation, helping maintain purchasing power.

How to Build a Robust Retirement Plan in 5 Steps

Step 1: Assess Your Financial Picture

Calculate your total assets, including home equity, retirement accounts, savings, and debts. Estimate your anticipated retirement expenses, factoring in healthcare and lifestyle needs to avoid surprises.

Step 2: Set Realistic Goals

Plan when you want to retire and what your lifestyle should look like. Consider geographical flexibility—moving to a less expensive area can stretch retirement dollars

Step 3: Maximize Savings and Diversify

Contribute regularly to 401(k)s and IRAs. Aim for a mix of investments: stocks for growth, bonds for stability, and cash for liquidity. Consider annuities as a stable income stream

Step 4: Plan Healthcare Flexibly

Healthcare costs can consume up to 30% of retirement expenses. Research Medicare options, long-term care insurance, and health savings accounts (HSAs) to mitigate these costs

Step 5: Use Home Equity Wisely

Think of home equity as a backup or supplement, not your core retirement fund. Explore downsizing only if it fits your needs. Reverse mortgages can help but fully understand fees and risks before proceeding

Tax Implications to Consider

- Capital Gains Exclusion: If you sell your primary residence, you can exclude up to $250,000 ($500,000 for couples) in gains if you meet ownership and use rules, providing a tax break.

- Property Taxes: Property tax can rise with inflation or local assessments, which can increase retirement living costs.

- Tax Benefits of Retirement Accounts: Contributions to traditional retirement accounts reduce current taxable income, while withdrawals in retirement are taxed. Roth IRA contributions are after-tax but qualified withdrawals are tax-free.

Real-Life Stories Highlighting the Risks and Rewards

Consider Carol from Ohio, who believed owning her home outright would carry her through retirement. When her medical expenses spiked unexpectedly, she struggled to access cash, forced to take out loans with high interest. Meanwhile, Mike diversified his savings alongside home ownership, which allowed him to cover emergency costs and enjoy peace of mind.

These examples emphasize the importance of diversification and planning for unexpected expenses.

The Top 3 Electrical Upgrades That Pay for Themselves

The Financial Case for Upgrading to a Tankless Water Heater

How to Create a “Sinking Fund” for Your Next Big Home Project