Good “Debt-to-Income” Ratio: When you’re ready to take the leap into homeownership, understanding your debt-to-income ratio, or DTI, is one of the smartest financial moves you can make. Your DTI ratio is the percentage of your gross monthly income that goes toward paying your debts, and lenders use it as a key measure of your ability to manage new loan payments. Essentially, it’s a snapshot of your financial health and your readiness to handle a mortgage responsibly. If you want to score a mortgage with good terms or simply understand your borrowing power, this guide breaks down everything you need to know about DTI—from what counts as debt, to what ranges lenders prefer, all the way to how you can improve your ratio. Whether you’re a first-time buyer or a seasoned homeowner looking to refinance, knowing your DTI can save you stress and set you up for long-term success.

Table of Contents

Good “Debt-to-Income” Ratio

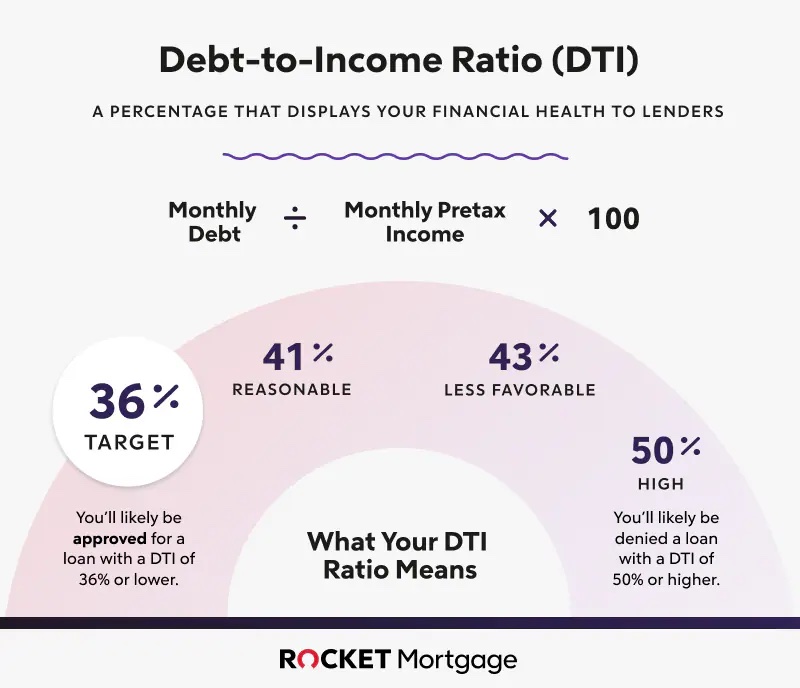

Your debt-to-income ratio is one of the most important numbers when you’re preparing to buy or refinance a home. A DTI below 36% is ideal, signaling to lenders that you’re managing debt responsibly and can comfortably afford your mortgage. Higher DTIs might still work but could mean higher interest costs or tougher loan approvals. Knowing how to calculate, interpret, and improve your DTI gives you control over your financial future and helps unlock homeownership dreams with confidence.

| Topic | Details |

|---|---|

| Ideal DTI Ratio | Below 36% total debts; max 28% on housing costs, per the 28/36 rule |

| Lenders’ Maximum DTI | Generally 43% to 50%, varies by loan type and borrower profile |

| Mortgage Impact | Lower DTI means better approval chances and more favorable interest rates |

| Calculation Method | DTI = Total monthly debt payments ÷ Gross monthly income |

| Loan Types & DTI Limits | Conventional, FHA, VA, USDA loans have varying DTI guidelines |

| Improvement Tips | Pay down debt, avoid new debt, increase income, refinance loans, save for bigger downpayment |

| Helpful Resources | CFPB, Fannie Mae |

Understanding Debt-to-Income Ratio: The Basics

Your debt-to-income ratio (DTI) is simply the fraction of your income that goes toward paying debts each month. To calculate it, you add up all monthly debt payments and divide that number by your gross (pre-tax) monthly income.

For example: If you owe $3,000 monthly on debts and earn $8,000 before tax, your DTI is:3,0008,000=0.375 or 37.5%\frac{3,000}{8,000} = 0.375 \text{ or } 37.5\%8,0003,000=0.375 or 37.5%

This tells lenders that 37.5% of your paycheck is committed to debt payments. They use this info to assess if you can take on additional debt—namely, a mortgage—and still keep your bills paid.

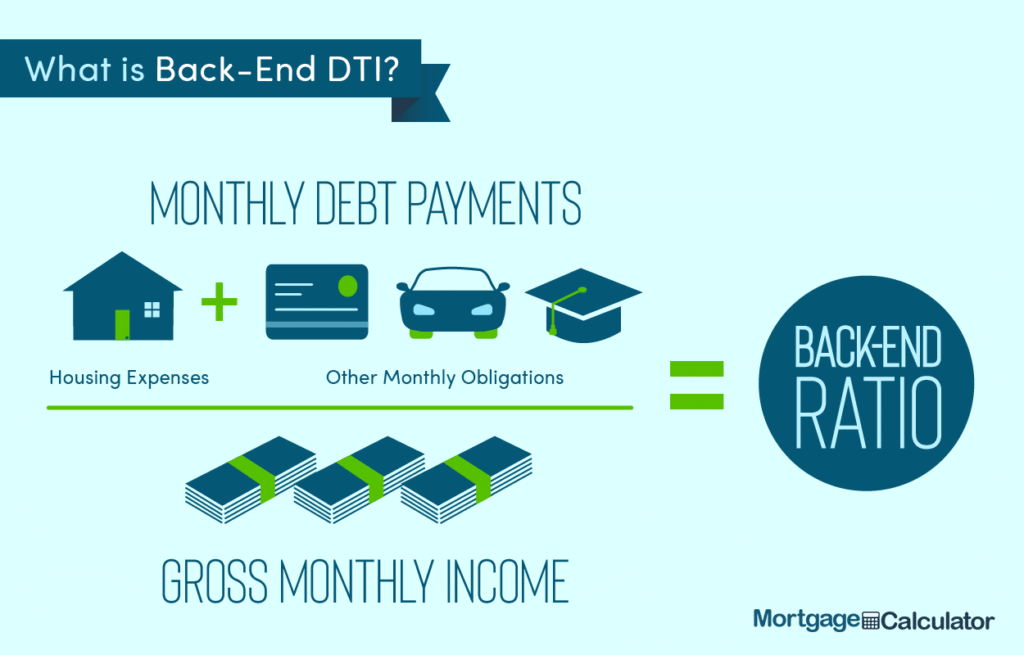

Types of DTI: Front-End vs. Back-End

- Front-End DTI looks only at your housing costs—mortgage principal and interest, property taxes, insurance, HOA fees.

- Back-End DTI includes all your monthly debts—housing, car loans, student loans, credit card payments, and any other minimum required debt payments.

Both are important, but lenders typically put more weight on your back-end DTI since it shows your complete debt burden.

Why Does Debt-to-Income Ratio Matter So Much?

This ratio helps lenders determine risk. High DTIs often signal that you might struggle to make payments on time, especially when new debts like a mortgage are added.

Lenders typically use the 28/36 rule as a guideline:

- Spend no more than 28% of your gross income on housing costs.

- Keep total monthly debt payments at or below 36% of your income.

Following this rule helps you maintain a balanced budget. However, some lenders allow higher DTIs (up to about 50%) if other factors, like savings or credit history, are strong.

What’s a Good Debt-to-Income Ratio for Homeowners?

The ideal DTI keeps you comfortable and maximizes your chances for mortgage approval:

- Below 36% total debt (back-end DTI): This is considered healthy and manageable.

- Up to 43%-50%: Some lenders may approve loans if you have excellent credit or assets.

- Above 43%-50%: Typically risky; lenders could decline or impose higher interest rates.

Staying within these levels means your debt load is sustainable. Being below 36% signals to lenders that you’re less likely to default.

How to Calculate Your DTI Ratio Accurately?

Step 1: Add All Monthly Debts

Include:

- Rent or current mortgage

- Car loans or leases

- Student loans

- Credit cards (minimum payments)

- Personal loans

- Alimony or child support

- Other recurring debts (HELOC, installment loans)

Exclude everyday expenses like utilities, groceries, or phone bills—lenders don’t count these.

Step 2: Calculate Your Gross Monthly Income

Add up all income sources before taxes, such as:

- Salary and wages

- Bonuses and commissions

- Freelance income

- Rental income

- Social security or retirement benefits (if applicable)

Step 3: Perform the Calculation

DTI=(Total Monthly Debt PaymentsGross Monthly Income)×100\text{DTI} = \left(\frac{\text{Total Monthly Debt Payments}}{\text{Gross Monthly Income}}\right) \times 100DTI=(Gross Monthly IncomeTotal Monthly Debt Payments)×100

Real-Life Example: Sarah and James

Sarah and James make $7,000 per month before taxes. Here’s their monthly debt:

- Car payment: $400

- Student loan: $300

- Credit cards: $250

- Proposed mortgage: $1,500

Total debt: $2,450

Calculating DTI:2,4507,000=0.35→35%\frac{2,450}{7,000} = 0.35 \rightarrow 35\%7,0002,450=0.35→35%

Their DTI is 35%, just under the ideal 36%, improving their odds of mortgage approval.

Loan Types and Their DTI Limits

Different loan programs have varying DTI ceilings:

- Conventional Loans: Usually max 36-43%, sometimes up to 45%.

- FHA Loans: Government-backed, tolerates up to 50% DTI with compensating factors.

- VA Loans: Often capped at 41% but flexible depending on borrower.

- USDA Loans: Usually cap at 41%, but exceptions exist.

Always check loan-specific DTI limits before applying.

Beyond DTI: Other Lending Factors

Lenders consider more than DTI when weighing your application:

- Credit Score: Higher scores can compensate for slightly higher DTIs.

- Down Payment: Bigger down payments mean smaller loans and better affordability.

- Savings & Reserves: Extra cash can ease lender concerns.

- Employment Stability: A steady job history reassures lenders.

- Loan-to-Value Ratio (LTV): A lower LTV ratio (loan amount vs home value) reduces risk.

Strategies to Lower Your Debt-to-Income Ratio

Pay Down Debt

Ignore the minimum payments—knock out your high-interest debts to reduce monthly obligations.

Avoid New Debt

Steer clear of new auto loans or credit cards before applying.

Boost Your Income

Work overtime, freelance, or start a side hustle to increase gross income.

Refinance Existing Loans

Lower interest on current loans means lower monthly payments.

Increase Down Payment

Save aggressively to cut loan size and monthly mortgage costs.

Why Does DTI Affect Interest Rates?

Lenders price loans based on risk. A higher DTI suggests greater risk, leading to:

- Higher interest rates

- Larger down payment requirements

- Stricter loan qualifying rules

A low DTI can land you lower rates, saving thousands over your loan term.

The 5 Hidden Costs of Homeownership (And How to Budget for Them)

The Financial Case for Upgrading to a Tankless Water Heater

How to Use IRS Form 5695 to Get Money Back on Your Home Upgrades