A Homeowner’s Guide to HVAC Financing: When you think of keeping your home cozy or cool, an HVAC system is the backbone of comfort. But making the move to a new HVAC setup can be a hefty investment. That’s why HVAC financing has become a game-changer for many homeowners across the U.S. It offers a way to get your heating, ventilation, and air conditioning needs sorted without dropping a lump sum upfront. This article dives deep into HVAC financing, highlighting your options, the pros and cons, and actionable advice, so you can pick the best plan for your budget and lifestyle.

Table of Contents

A Homeowner’s Guide to HVAC Financing

HVAC financing unlocks the door to a comfortable home without the sting of paying upfront. But it’s not a one-size-fits-all—knowing your options, rates, and terms is key. Shop smart, get multiple quotes, and lean on professionals to size your system and finance your comfort wisely. Remember, smart financing plus smart equipment equals both comfort and savings.

| Topic | Key Data/Stats | Additional Info |

|---|---|---|

| Average HVAC Cost | $4,500 to $9,000 for full systems | Mini-splits: $1,500 – $4,000 |

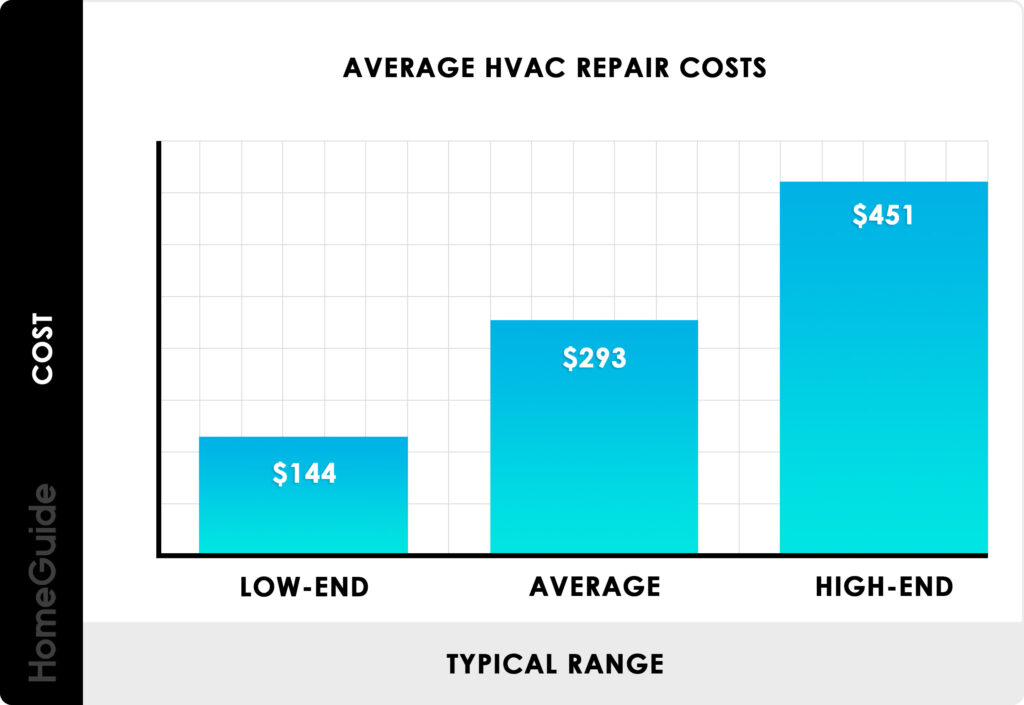

| Annual HVAC Spending (U.S.) | $14+ billion on repairs | HVAC market growth predicted 7.4% annually until 2030 |

| Financing Interest Rates | 0% promotional to 36% depending on option | Personal loans: 6%-36%, home equity: ~7%-15% |

| Tax Credits | Up to $2,000 credits for heat pumps | Available through 2032 |

| Approval Time | Instant to 6+ weeks | Credit cards/contractor financing: same day; home equity: longer |

| Official Resource | U.S. Department of Energy | For government rebates and loan programs |

Why HVAC Financing Matters?

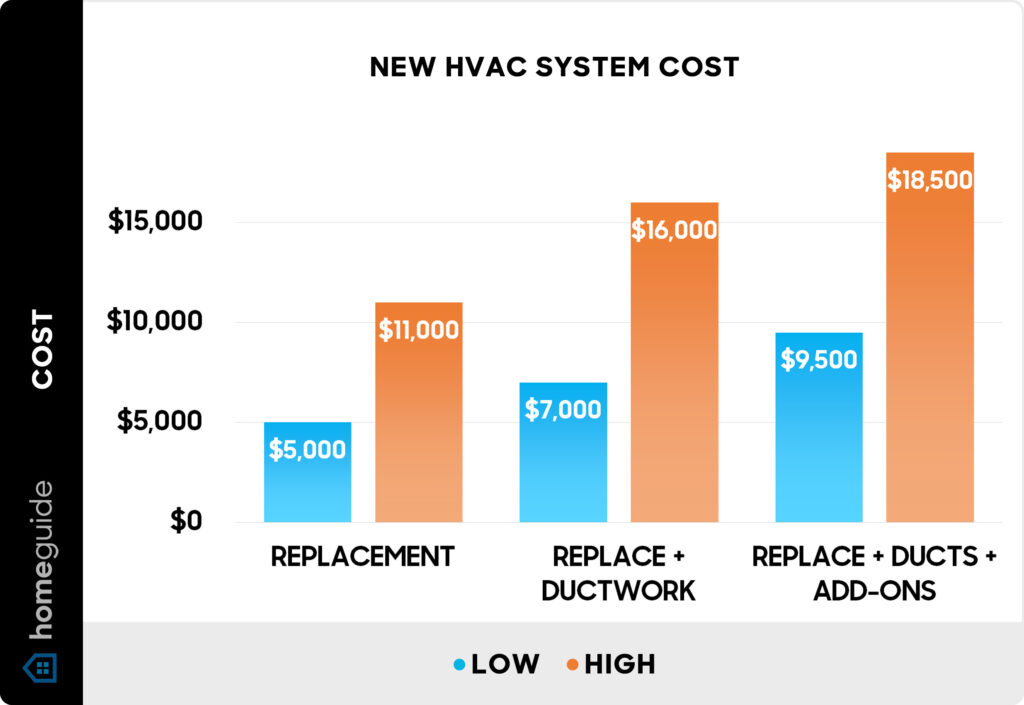

Upgrading or installing a new HVAC system is no small feat. A typical full HVAC system ranges from $4,500 to $9,000, and even mini-splits can run between $1,500 and $4,000. For the average American household, that’s a significant expense. Plus, repairs and replacements are often urgent—your AC just broke down in the middle of July, and waiting to save won’t cut it.

Here’s the scoop: HVAC financing lets you spread these costs out over months or years, helping you manage your cash flow better. More importantly, using financing to buy energy-efficient systems means you can reduce monthly energy bills and even qualify for tax credits, stretching your dollar further. The HVAC market in the U.S. is set to grow by approximately 7.4% annually until 2030, reflecting the rising demand and advances in energy technology, making financing a relevant option today.

A Homeowner’s Guide to HVAC Financing Options Explained

Personal Loans: Fast and Flexible but Can Be Pricey

What They Are: Unsecured loans from banks, credit unions, or online lenders that let you borrow money without putting up collateral.

Pros:

- Quick turnaround on approval.

- Fixed monthly payments for predictable budgeting.

- No risk to your home assets.

Cons:

- Interest rates vary widely, higher if credit isn’t top-notch (6%-36%).

- May affect your credit score during application.

Walkthrough: Imagine applying for a $7,000 personal loan with an 8% interest rate for 3 years, resulting in payments around $220 monthly. While manageable, watch out if your credit score dips, which can hike rates considerably.

Home Equity Loans and HELOCs: Lower Interest But Higher Risk

What They Are: Borrowing against the equity you’ve built in your home through a second mortgage (home equity loan) or a line of credit (HELOC).

Pros:

- Typically lower interest rates (around 7%-15%).

- Interest might be tax-deductible.

- Larger borrowing limits for big projects.

Cons:

- Your home is collateral—missing payments risks foreclosure.

- Approval can take longer (weeks).

- Longer repayment terms (10-15 years).

Best for: Homeowners confident in stable finances who want to reduce interest costs over the long haul.

Credit Cards: Quick, Short-Term, but Watch Out for Interest

What They Are: Using a credit card to pay for HVAC with potential 0% promotional APR offers for 6-18 months.

Pros:

- Instant access, no loan application.

- Promotional 0% APR eases initial payments.

Cons:

- High interest once promo ends (can exceed 20% APR).

- Risk of accumulating expensive debt if not paid off on time.

Use if you’re disciplined and can pay within the promo window.

Manufacturer and Contractor Financing: Convenient but Read the Fine Print

What They Are: Many HVAC companies and brands offer in-house financing with promotional rates, often serviced by third-party lenders.

Pros:

- Quick approvals—can be done during installation.

- Promotional 0% interest deals for 6-24 months.

- Sometimes bundled with extended warranties or maintenance.

Cons:

- Deferred interest can apply if you miss payments.

- Limited to specific brands or contractors.

- Higher interest after promo period if balance remains.

Always ask for full terms to avoid surprises.

How to Choose the Right HVAC Financing Option?

- Assess Your Credit Health: Check your credit score beforehand—higher scores get better interest rates.

- Determine Your Budget: Calculate how much you can afford monthly to avoid overextending.

- Consider Term Length: Longer terms mean lower monthly payments but more interest paid overall.

- Look for Energy Incentives: Factor in local/state rebates and federal tax credits (up to $2,000 for qualifying heat pumps).

- Talk to Multiple Lenders and Contractors: Get at least three quotes—compare interest rates, repayment terms, fees, and incentives.

- Read the Fine Print: Understand penalties, fees, variable interest rates, and deferred interest clauses.

The Importance of Energy Efficiency

Choosing an ENERGY STAR® certified or highly efficient system might cost more upfront but saves you money on utilities over time. These systems also qualify for rebates and tax credits through government programs such as the Inflation Reduction Act, reducing your net costs.

For example, replacing an old AC unit with a high-SEER (Seasonal Energy Efficiency Ratio) system reduces electricity usage and can earn you tax credits up to $600 or more [energy.gov].

Avoiding Common Pitfalls in HVAC Financing

- Don’t Skip the Fine Print: Some deals appear sweet but have steep deferred interest or penalties.

- Don’t Ignore Your Budget: Choose payments that won’t stress your finances in emergencies.

- Don’t Forget to Get Multiple Quotes: Pricing and financing offers vary widely.

- Don’t Overbuy: Bigger systems don’t always mean better efficiency. An HVAC professional should size your system properly.

- Don’t Forget Maintenance Plans: Sometimes bundled offers include maintenance, which can save costs long-term.

Real-World Example

Say you finance a $7,000 HVAC system through contractor financing with a 0% APR for 12 months. If you stick to the plan and pay $583 monthly, you avoid interest. Miss a payment, and that deferred interest of 12%-20% kicks in, ballooning your total cost.

Alternatively, a 7-year home equity loan could lower your monthly payments but ties your home to the debt and adds interest costs over time.