Asset Allocation for Beginners: When most folks think about building wealth, their minds jump straight to owning a home. And hey, owning a piece of property is powerful. But if you wanna get serious about your financial future, asset allocation has gotta be in your toolkit. Asset allocation means spreading your money across different types of investments—not just your home equity—to balance risk and reward. This strategy can help you grow your money steadily, even when markets throw curveballs. No worries if this stuff sounds confusing at first. This guide breaks asset allocation down so even a 10-year-old could get it, while giving pros some solid insights. We’ll cover what asset allocation means, why it’s important, common types of assets to include beyond your house, how to build your portfolio, strategies for long-term success, and practical tips to stay on track.

Table of Contents

Asset Allocation for Beginners

Asset allocation spreads investments beyond home equity into stocks, bonds, real estate, cash, and more. This balance mitigates risk and smooths growth, setting the stage for financial success. For beginners, starting with clear goals, a personalized mix, diversified funds, and regular rebalancing is smart investing 101. Remember: building wealth takes time, patience, and a solid plan—and a well-allocated portfolio will be your best companion on this path.

| Key Concept | Details |

|---|---|

| What is Asset Allocation? | Distributing investments among asset classes to balance risk and gain. |

| Popular Asset Classes | Stocks, bonds, real estate, cash, gold, ETFs, alternatives. |

| Importance | Diversifies risk; enhances long-term returns. |

| U.S. Market Data (2025) | US assets totaled $39.56 trillion as of Q2 2025 (bea.gov). |

| Growth of ETFs | Active ETFs growing, reshaping investment access (McKinsey 2025). |

| Diversification Benefit | Reduces portfolio volatility and smoothes returns (BlackRock, 2024). |

| Beginner’s Tip | Start with a balanced mix based on your risk tolerance. |

What Is Asset Allocation and Why It Matters?

Simply put, asset allocation is deciding how much of your money to put into different kinds of investments. Think of your investment portfolio like a pizza. You don’t want it all pepperoni; maybe some pepperoni, some mushrooms, onions, and cheese for balance and flavor. Same goes for your money.

Putting all your eggs in one basket—like your home equity—can be risky. While your home might appreciate in value with time, real estate as an asset can have periods of stagnation or decline and isn’t easily liquidated unlike stocks or bonds.

Different assets behave differently, especially during turbulent markets:

- Stocks offer growth but can be volatile.

- Bonds provide stability and income.

- Real estate can shield from inflation but lacks liquidity.

- Cash equivalents provide safety but low returns.

Data from the U.S. Bureau of Economic Analysis shows U.S. assets totaling $39.56 trillion in mid-2025, reflecting diverse investment patterns that underscore why diversification matters.

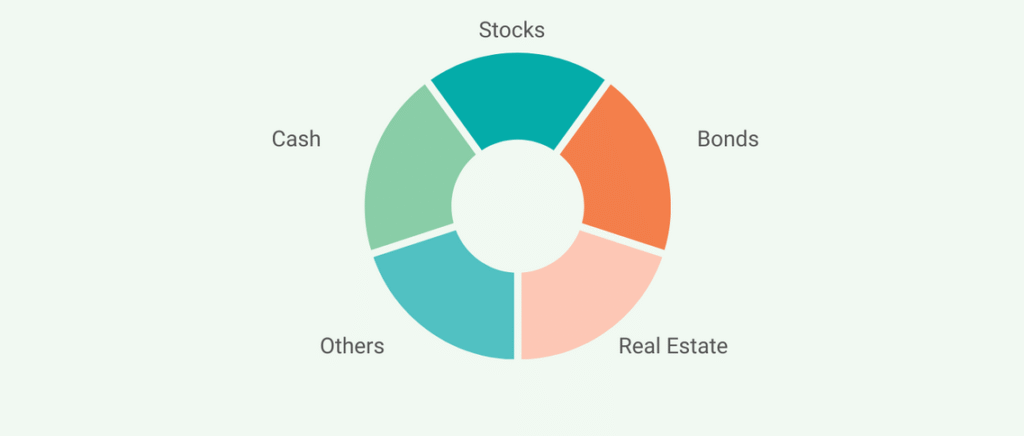

Popular Asset Classes to Include Beyond Your Home

Diversification across a range of asset classes is key to mitigating risk and unlocking growth potential. Here’s a deeper look:

1. Stocks (Equity)

Stocks represent ownership in publicly traded companies. With an average annual return around 7-10% historically, stocks primarily contribute to wealth growth, especially over long periods. However, they can be highly volatile — prices can swing dramatically, influenced by economic conditions, corporate performance, and geopolitical events.

Examples include large-cap companies like Apple or tech disruptors like Tesla. Investing in index funds or ETFs that track major stock indices can spread risk within stocks.

2. Bonds (Debt)

When you buy bonds, you’re lending money to governments or corporations for fixed interest payments. Bonds are less volatile than stocks and provide steady income, making them a hedge against stock market dips.

US Treasury bonds, municipal bonds, and corporate bonds differ in risk and yield. Incorporating bonds can reduce portfolio swings, especially important as you near retirement.

3. Real Estate (Other than Your Home)

Real estate investments go beyond your personal property. Options include:

- Rental properties providing cash flow through rent.

- Real Estate Investment Trusts (REITs), which allow you to invest in commercial real estate without direct ownership.

Real estate diversifies portfolios, acts as an inflation hedge, and often has a low correlation with stocks and bonds, offering downside protection.

4. Cash and Cash Equivalents

Holding cash or equivalents (money market funds, savings accounts) provides liquidity and safety. These assets protect capital and fund emergencies or opportunities but yield low returns that may not keep pace with inflation.

5. Commodities (Gold, Silver, etc.)

Gold is the most popular commodity for asset diversification. It tends to hold value during inflation spikes or economic uncertainty but does not produce income. Including commodities can shield the portfolio during market declines.

6. Alternative Investments

Alternatives like peer-to-peer lending, private equity, hedge funds, or collectibles diversify risk further. They often have less liquidity and require more research but can deliver uncorrelated returns.

Incorporating Tax-Advantaged Accounts

Maximize asset allocation effectiveness with tax-advantaged accounts like 401(k)s, Traditional and Roth IRAs. Locating the right assets in these accounts minimizes tax drag:

- 401(k) plans often provide employer matching and allow pre-tax contributions.

- Traditional IRAs let your investments grow tax-deferred.

- Roth IRAs let investments grow tax-free after paying taxes upfront.

By aligning your asset allocation with tax-efficient strategies, you can keep more of what you earn and compound over the long term.

Step-By-Step Guide: Building Your First Diversified Portfolio

Step 1: Define Your Financial Goals and Timeline

Are you saving for retirement, kids’ education, or a home down payment? Clarifying your timeline and purpose helps choose risk levels.

Step 2: Assess Your Risk Comfort Zone

Be honest about how much market ups and downs stress you out. Questionnaires and financial advisors can help identify your tolerance.

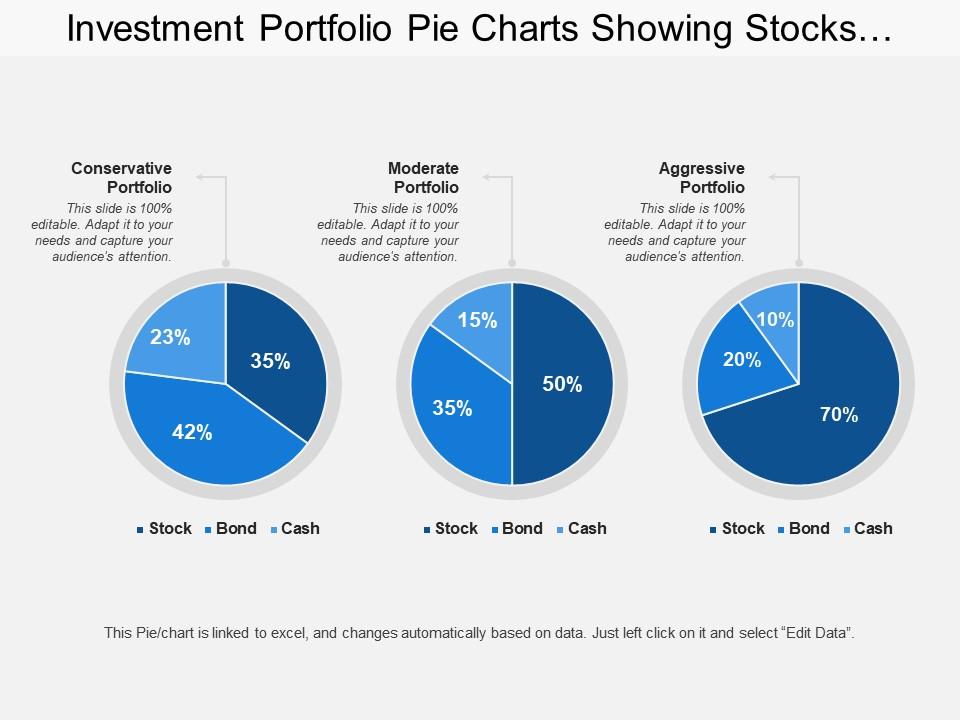

Step 3: Decide Your Asset Mix

Tailor your asset allocation based on goals and risk tolerance. A younger person might have 70% stocks while a retiree might favor bonds and cash.

Example portfolio allocations:

| Risk Level | Stocks | Bonds | Real Estate | Cash | Commodities |

|---|---|---|---|---|---|

| Conservative | 30% | 50% | 10% | 5% | 5% |

| Moderate | 50% | 30% | 10% | 5% | 5% |

| Aggressive | 70% | 15% | 10% | 3% | 2% |

Step 4: Choose Investments

Options include index funds, ETFs, and mutual funds to gain broad exposure at low cost. Investing through diversified funds helps beginners avoid concentrating risk.

Step 5: Monitor and Rebalance

Over time, stocks might grow and dominate your portfolio, shifting your risk. Rebalancing means selling assets that have grown beyond your limits and buying those that lag, restoring your target allocation.

Asset Allocation Strategies to Consider

Strategic Asset Allocation

A long-term approach where you set target allocations and rebalance periodically. It’s simple and effective for most investors.

Tactical Asset Allocation

Adjusts allocations temporarily based on market trends aiming for higher returns but involves market timing risks.

Dynamic Asset Allocation

Frequent adjustments reacting to changing market conditions, requiring active management.

Age-Based Allocation

Adjusts equity exposure based on age; rule of thumb is 100 minus your age gives the percent in stocks, shifting more to bonds as you get older.

Why Diversification Works: Data and Real-World Benefits

Diversification lowers portfolio risk and smooths returns. For example, when stocks slump, bonds or gold often gain, cushioning downturns. According to BlackRock’s 2024 analysis, mixing diverse asset classes reduces volatility and improves long-run returns. McKinsey’s 2025 report shows how ETFs and global diversification help investors spread risk and access new markets efficiently.

The Psychology of Asset Allocation: Keepin’ It Real

Money and emotion are linked. Market drops often trigger panic selling, but sound asset allocation helps keep you calm and disciplined.

Focus on your long-term goals and realize market dips are normal. Patience and consistency are your best friends on the wealth-building journey.

Understanding “Green Loans”: Financing for Energy-Efficient Home Upgrades

Are Home Improvements Tax Deductible? (The Answer May Surprise You)