How to “Pay Yourself First” to Build a Home Repair: When it comes to making your money work for you, the Pay Yourself First strategy is the real MVP of personal finance. The idea is simple: set aside cash for your goals before paying bills, buying groceries, or hitting up Amazon for that impulse buy. In this guide, you’ll discover how this powerhouse approach can help you grow both a home repair fund and a retirement nest egg—all while keeping life easy and stress-free. Whether you’re a Wall Street pro or a beginner just starting out, these steps break things down so anyone, even a sharp 10-year-old, can get a grip on their financial future.

Table of Contents

How to “Pay Yourself First” to Build a Home Repair?

The Pay Yourself First routine is not just good advice—it’s a financial game changer. Prioritize your savings by funneling money as the first expense each month, splitting it wisely between urgent home repair needs and future retirement goals. Automation, discipline, and regular reviews help you build wealth while avoiding debt traps and financial stress. Start wherever you are, stay consistent, and watch your financial security grow day by day.

| Topic | Data/Stat | Practical Insight |

|---|---|---|

| % Americans saving < 10% | 74% | Most folks need to boost savings for emergencies or retirement |

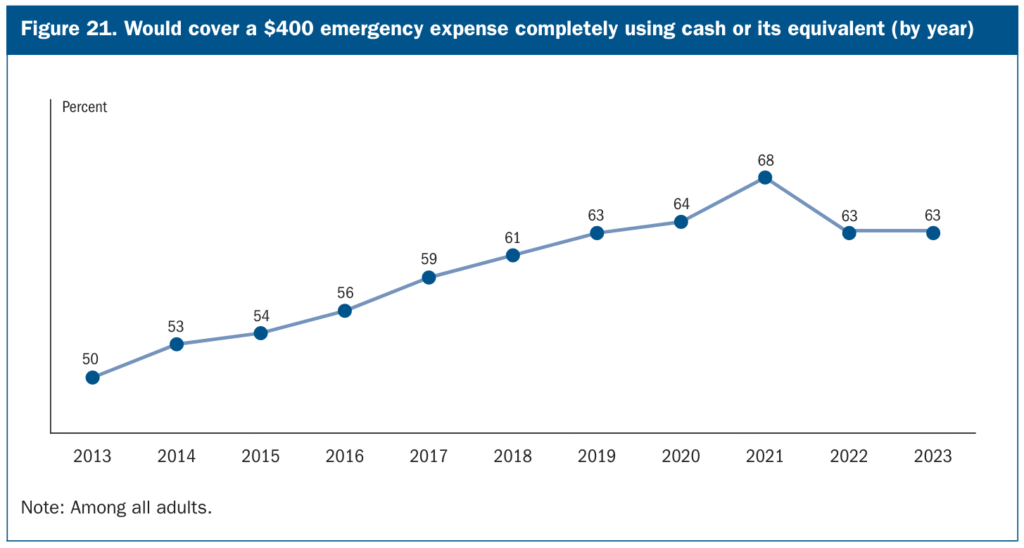

| Cannot cover $400 emergency | 37% | Building an emergency/home repair fund is crucial |

| Avg retirement savings | $331,000 | Higher incomes save more; always aim to start early |

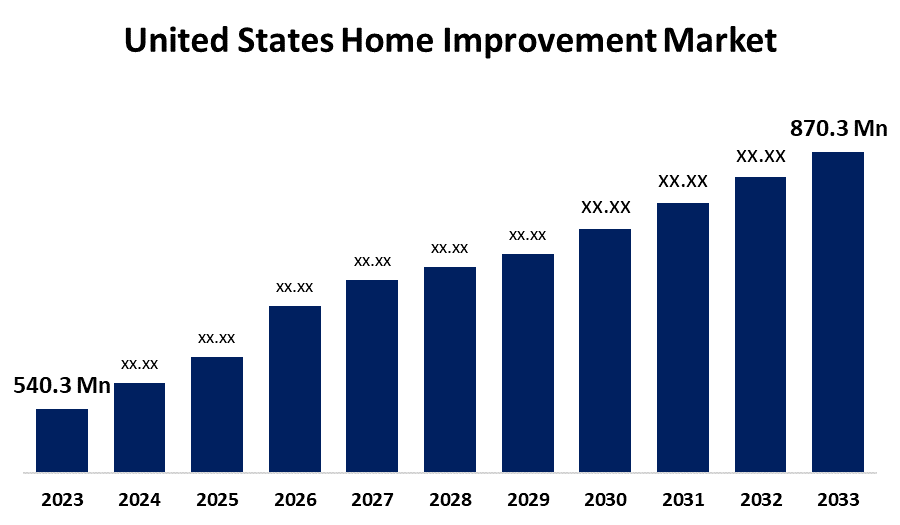

| Home improvement spending | $827B (2023) | Cash from savings is the cheapest way to fund repairs |

| >27% no emergency savings | 27% | Make saving a non-negotiable line item each month |

| Savings split guideline | 80/20 | Allocate 20% income to savings, split for goals |

| Federal official advice | Official worksheets for savings plans | Use tools from the Dept. of Labor for step-by-step help |

WHAT IS “PAY YOURSELF FIRST” AND WHY DOES IT MATTER?

“Pay Yourself First” is a proactive, disciplined approach where you treat saving as the very first thing you do with your paycheck—before paying bills, buying groceries, or spending on entertainment. This flips the traditional budgeting mindset, ensuring that saving isn’t just an afterthought but a non-negotiable financial priority. According to recent data, over 74% of Americans save less than 10% of their income, and 37% cannot cover a $400 emergency expense without borrowing or selling belongings. This highlights a widespread need for disciplined savings strategies to avoid financial crisis and secure the future.

“Pay Yourself First” becomes a powerful habit that creates a safety net and builds long-term wealth. It reduces financial stress by making savings consistent and automated, so you don’t have to rely on willpower or end-of-the-month leftovers.

THE BIG PICTURE: WHY SPLIT YOUR SAVINGS?

Life throws curveballs—like a burst pipe or an unexpected furnace failure—when you least expect it. That’s why having a home repair fund is critical to avoid draining your credit or taking high-interest loans. At the same time, building your retirement fund protects your future financial independence, letting you retire with dignity and comfort without the stress of working past your golden years.

Splitting your money between immediate needs (home repairs) and long-term security (retirement) ensures balanced growth for both. This dual-focused approach prevents the pitfall of neglecting one goal for the other.

- Home Repair Fund: Keeps you agile against emergency home expenses not covered by insurance, such as roof leaks, appliance breakdowns, or plumbing disasters.

- Retirement Fund: Grows over decades, benefiting from compound interest and tax advantages, to support you when work income stops.

This balance mitigates the risk of dipping into retirement savings for short-term crises, preserving your long-term wealth-building timeline.

STEP-BY-STEP GUIDE: How to “Pay Yourself First” to Build a Home Repair

1. Calculate Your Take-Home Pay

Begin by identifying your monthly take-home income (after taxes and deductions), since your budgeting, including savings, depends on this net amount. This number forms the foundation of your savings plan. For example, if you receive $4,000 a month post-tax, all your allocations should be based on this figure.

2. Set Smart Savings Goals

Start by deciding a savings rate that reflects your financial reality and goals. Experts usually recommend saving between 10% and 20% of your income monthly. If this feels overwhelming, start small ($25-$50) and increase gradually. Consistency matters more than amount when building savings habits.

Define clear targets for both funds:

- Emergency/Home Repair Fund: Enough to cover 3-6 months of typical repair costs.

- Retirement Fund: Aim for at least 15% of your income eventually, considering employer match opportunities and tax advantages.

Write goals down to establish commitment and clarity.

3. Divide Your Savings by Purpose

Customize your split to suit your situation. Here’s an illustrative example for someone earning $4,000 monthly:

| Fund Type | % of Income | Monthly Amount | Use Case |

|---|---|---|---|

| Retirement | 12% | $480 | IRA, Roth IRA, 401(k) contributions |

| Home Repairs | 8% | $320 | High-yield savings or liquid accounts for repairs |

You could tweak these ratios upward or downward based on debts, age, home condition, or other priorities.

4. Automate Transfers

Automation is the secret sauce. Set your bank or employer to automatically deposit the designated amounts into separate accounts on payday. By making it automatic, you remove temptation and increase discipline, transforming savings into a “pay yourself first” bill.

Leverage apps like Mint, You Need a Budget (YNAB), or your bank’s auto-transfer services to streamline this process and monitor your progress without hassle.

5. Set Up Separate Accounts

Keep funds distinct to avoid commingling:

- Retirement Account: Utilize tax-advantaged accounts like a 401(k), Roth IRA, or traditional IRA to maximize growth and reduce your tax burden.

- Home Repair Fund: Prefer a high-yield savings account accessible without penalties, preferably FDIC-insured, to earn some interest while keeping funds liquid for emergencies.

6. Boost Funds Over Time

As your income grows or your financial situation changes—such as getting a raise or paying off debt—increase your savings rate. Regularly boosting your contributions keeps your savings growing ahead of inflation and lifestyle creep.

Set reminders every 6-12 months to revisit and adjust your plan, optimizing your contributions.

7. Track and Adjust

Track your savings growth with budgeting tools or spreadsheets. Doing periodic check-ins (quarterly or bi-annually) helps you stay accountable and make adjustments—whether that means shifting focus temporarily to a repair fund if your house needs work, or putting more away for retirement during stable times.

Staying flexible is key to addressing changing needs without falling behind on overall goals.

8. Use Official Resources for Guidance and Motivation

Several official resources provide tools and advice to build your savings effectively:

- Department of Labor’s “Savings Fitness” Guide offers a stepwise approach to setting and reaching goals.

- Consumer Financial Protection Bureau (CFPB) gives beginner-friendly advice on emergency funds.

- Investopedia and NerdWallet offer calculators, up-to-date strategy articles, and retirement planning tools for various income levels.

Leveraging these helps reinforce smart money habits and fills knowledge gaps.

STYLE OF SAVING: PICK THE ONE THAT FITS YOU

You don’t have to stick to one style. Many find success by mixing these:

- Reverse Budgeting: Save first, then spend only what remains. It’s a mindfulness shift that breeds discipline.

- Zero-Based Budgeting: Assign every dollar a function—savings included. No money is left unaccounted for.

- Microsaving: Use technology that rounds up your purchases to the nearest dollar and saves the difference automatically.

- Side Hustle Boost: Dedicate secondary income streams fully or partially to accelerating savings.

Find what feels natural but pushes you enough to keep growing your savings.

DEALING WITH ORDINARY CHALLENGES

Even the best plans run into speed bumps. Here’s what to expect and how to tackle them:

- Overspending Temptations: Use digital tools to enforce limits and remind yourself why saving is non-negotiable.

- Unexpected Large Expenses: That’s the exact purpose of your home repair fund—to handle surprises without stress.

- Income Fluctuations: Keep contributions proportional; when earnings dip, reduce savings temporarily but always save something.

- Losing Motivation: Celebrate milestones and visualize the freedom your funds bring.

Remember, flexibility combined with commitment is the winning formula.

REAL-LIFE EXAMPLES SHOWING PAY YOURSELF FIRST IN ACTION

Example 1: Newbie Saver

Nikki is 25, a teacher earning $2,500/month post-tax. She automates 10% to a Roth IRA ($250) and 5% ($125) into a home repair savings account. Using Mint on her phone, she tracks progress. After one year, Nikki has built a solid emergency buffer and retirement base, thanks to consistent, painless habits.

Example 2: Mid-Career Professional

Marcus runs a car wash, takes home $8,000 monthly. He saves 20%—divided equally between a SEP IRA and a liquid home repair fund. He consults a financial advisor annually to adjust based on his growing income and evolving goals.

STATISTICS & INSIGHTS YOU SHOULD KNOW

- $827 billion was spent on home improvements in 2023, making a repair fund indispensable to avoid costly loans.

- 37% of adults can’t cover a $400 emergency expense without outside help.

- Average retirement savings for 35–64-year-olds hover around $331,000, but many Americans have much less.

- 27% of Americans lack any emergency savings, showing the urgency of disciplined saving behavior.

PRO TIPS AND SLANG TO MAKE IT STICK

- “Set it and forget it”: Automate savings and remove manual decision-making.

- “Rainy day fund”: Keeps repair money safe for inevitable home emergencies.

- “Boss move”: Increasing savings percentage whenever you get a raise.

- “Side hustle $$”: Funnel extra income towards your savings goals.

- “Zero effort savings”: Rely on banking tech to do the heavy lifting for you.

5 Credit Score Mistakes to Avoid When Financing a Home Repair

The “Oh No!” Fund: How Much to *Really* Save for Emergency Home Repairs

Does Homeowner’s Insurance Cover a Broken Furnace or Water Heater?