How to Use IRS Form 5695 to Get Money Back on Your Home Upgrades: If you’re a U.S. homeowner looking to save money on your energy-efficient home upgrades, IRS Form 5695 is your key to getting federal tax credits. These credits can significantly reduce your tax bill by rewarding you for making environmentally friendly improvements such as installing solar panels, upgrading to energy-efficient windows, or improving insulation. This comprehensive guide breaks down everything you need to know about IRS Form 5695 in 2025 — from eligibility and required documentation to step-by-step filing instructions and practical tips to maximize your credit. Whether you’re a first-time filer or a seasoned tax pro, this article will help you confidently claim valuable tax savings.

Table of Contents

How to Use IRS Form 5695 to Get Money Back on Your Home Upgrades?

IRS Form 5695 is a powerful tool in 2025 for U.S. homeowners to recoup a significant portion of their investment in clean and energy-efficient home upgrades. By claiming the Residential Clean Energy Credit or the Energy Efficient Home Improvement Credit, taxpayers can cut their tax bills by thousands of dollars while making their homes more comfortable, environmentally friendly, and valuable. Proper documentation, careful completion of the form, and timely filing with your tax return are critical to maximize benefits. Be sure to check eligibility carefully, track all costs and certifications, and plan your upgrades before the December 31, 2025 deadline. With thoughtful preparation, you can turn green investments into solid tax savings that benefit both your wallet and the planet.

| Feature | Details |

|---|---|

| Form Used | IRS Form 5695 |

| Credits Available | Residential Clean Energy Credit (30% of costs) and Energy Efficient Home Improvement Credit (up to $1,200/year) |

| Eligible Upgrades | Solar panels, heat pumps, efficient windows, doors, insulation, furnaces, water heaters |

| Deadline for Credit Eligibility | Improvements must be placed in service by December 31, 2025 |

| Average Credit Claimed by Homeowners | $5,084 for clean energy; $882 for energy efficient improvements (2023 data) |

| How to File | Attach Form 5695 with Form 1040 Schedule 3 |

What is IRS Form 5695?

IRS Form 5695 is used to claim federal tax credits that help offset the costs of making your home more energy efficient and environmentally sustainable. Unlike tax deductions, which reduce your taxable income, tax credits reduce the actual amount of tax you owe dollar-for-dollar, making them very valuable. This form covers two main credits:

- Residential Clean Energy Credit: This credit provides 30% back on qualified expenses for renewable energy systems such as solar electric panels, solar water heaters, geothermal heat pumps, and small wind turbines. Eligible labor, equipment, and installation costs qualify for the credit. Starting in 2025, battery storage technology with at least 3 kilowatt-hours capacity also qualifies.

- Energy Efficient Home Improvement Credit: This credit applies to energy-saving improvements like ENERGY STAR® certified windows, doors, insulation, furnaces, boilers, and water heaters. It also offers a credit equal to 30% of qualified costs, but with annual caps—for example, a $250 limit per exterior door and a combined $1,200 cap on many improvements per tax year.

In summary, Form 5695 helps homeowners claim credits on meaningful home upgrades that reduce energy consumption and electricity costs, providing immediate tax relief and long-term savings.

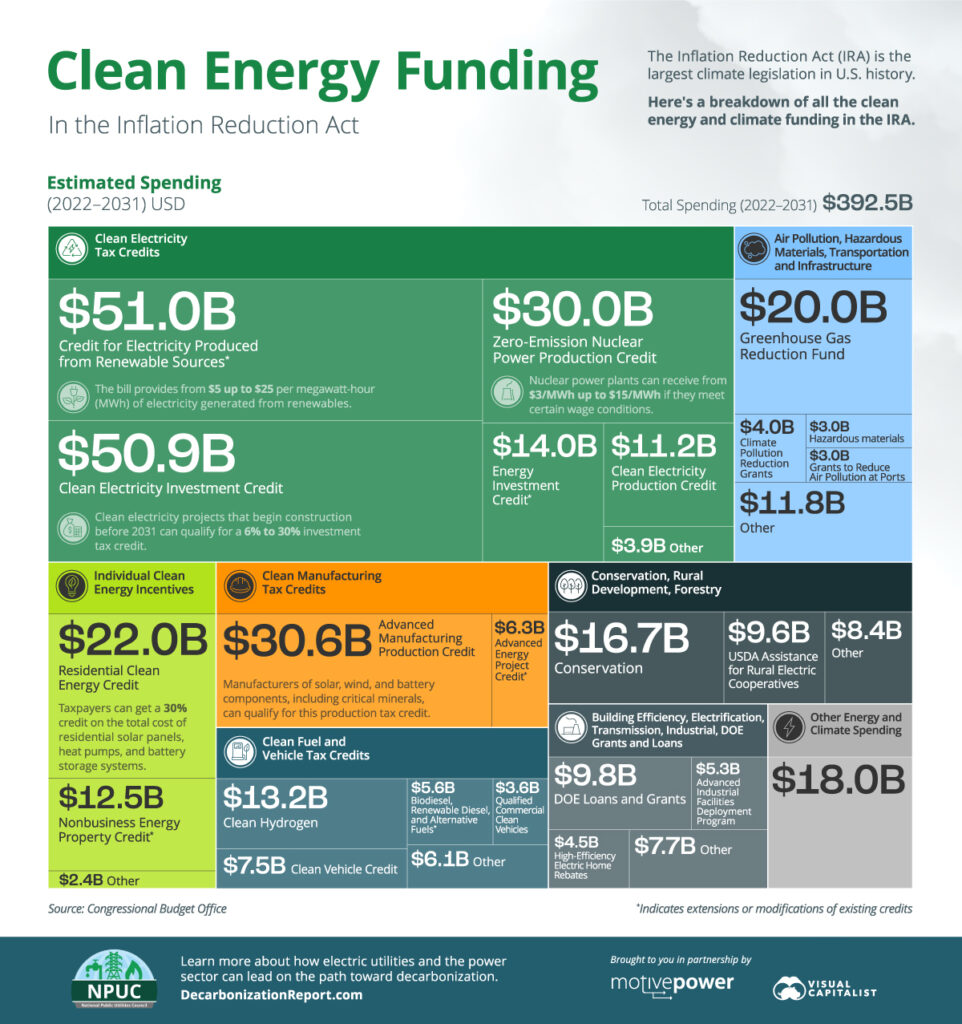

Why Use IRS Form 5695 to Get Money Back on Your Home Upgrades?

Federal energy tax credits are a critical incentive for homeowners nationwide aiming to reduce energy bills and environmental impact. Data from 2023 reveals more than $8.4 billion was claimed by taxpayers for clean energy improvements, with the average household receiving over $5,000 from the Residential Clean Energy Credit alone, plus nearly $900 from energy efficiency upgrades. These credits lower your upfront investment in renewable and efficient technologies, helping maximize return on investment and property value while supporting the U.S.’s clean energy goals.

With electric bills climbing and climate change awareness growing, using Form 5695 means putting green home upgrades within reach for millions of Americans, allowing you to save money and energy simultaneously.

Expanded Step-by-Step Guide to Use IRS Form 5695 to Get Money Back on Your Home Upgrades

Step 1: Confirm Eligibility of Your Upgrades

Be sure your upgrades qualify under IRS rules for 2025:

Residential Clean Energy Credit:

- Solar photovoltaic panels and systems including inverters and racking.

- Solar water heaters certified by the Solar Rating and Certification Corporation (SRCC).

- Geothermal heat pumps meeting ENERGY STAR® standards.

- Small wind turbines used primarily to generate electricity for your home.

- Battery storage technology with at least 3 kWh capacity (often paired with solar systems).

- Fuel cell property with electricity-only generation efficiency over 30%.

Energy Efficient Home Improvement Credit:

- ENERGY STAR® certified windows, skylights, and exterior doors.

- Insulation to improve heat retention.

- Efficient central air conditioners, heat pumps, boilers, and water heaters.

- Biomass stoves and boilers.

- Electrical panel upgrades meeting qualified requirements.

Improvements must be made to your main or secondary U.S. home, and must be installed and placed in service by December 31, 2025, to qualify. New home construction expenses do not qualify.

Step 2: Gather Comprehensive Documentation

Organizing your paperwork is vital. Keep detailed records such as:

- Itemized purchase receipts showing product and labor costs separately.

- Manufacturer certifications verifying product eligibility.

- Installation contracts and permits.

- Documentation of any rebates or incentives received from local or state programs (subtract these from total costs before calculating credit).

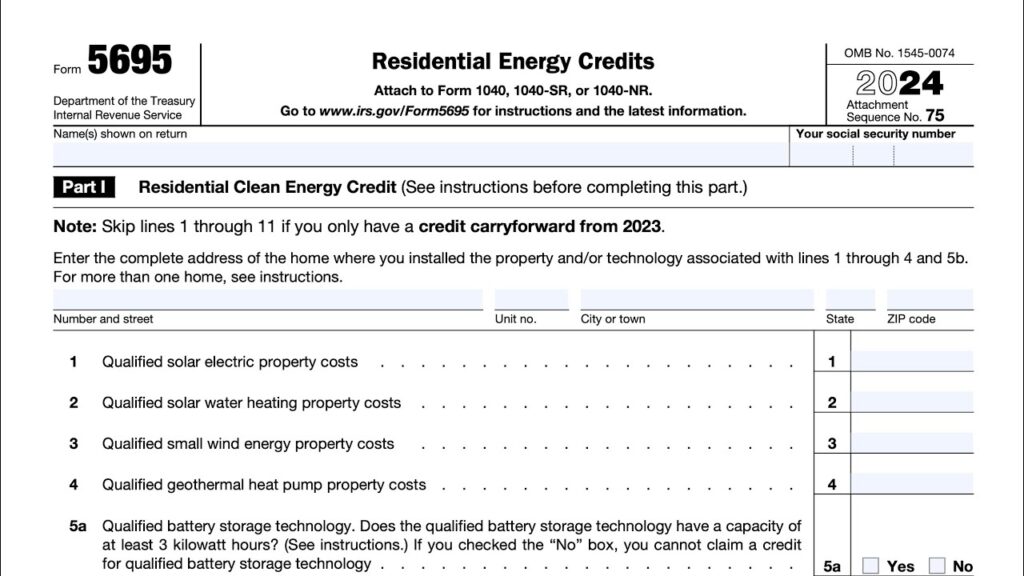

Step 3: Fill Out IRS Form 5695

- In Part I, list your renewable energy system expenses for the Residential Clean Energy Credit, including solar panels, inverters, and battery systems.

- In Part II, enter costs related to energy-efficient home improvements.

- The form guides you in applying credit limits — for example, $250 max per exterior door and up to $1,200 total for many improvements annually.

- Include any unclaimed credit carried over from prior years.

- After calculating your total credit, transfer it to Schedule 3 (Form 1040) on line 5b.

- Attach Form 5695 to your filed tax return.

Step 4: File and Record Maintenance

File your completed tax return with the attached Form 5695. If you use tax software, it usually automates much of this process. Keep all tax documents, invoices, and certifications for at least three years to be prepared for any IRS audits or inquiries.

Additional Eligibility Details and Special Considerations

- Joint owners of a property should each file their own Form 5695 for their share of expenses when filing separately.

- Leased solar equipment generally does not qualify for the credit; only owners can claim it.

- If you have multiple homes, complete a separate Form 5695 for each and combine credits as instructed.

- Certain advanced heating and cooling equipment now require manufacturer-issued product ID numbers (PINs) to qualify for the credit.

- Rental and commercial property are excluded from these credits; specialized business-related credits exist elsewhere.

Understanding “Green Loans”: Financing for Energy-Efficient Home Upgrades

A Homeowner’s Guide to HVAC Financing: The Pros and Cons of Your Options

How to Pay for an Emergency Plumbing Disaster (When You Have No Savings)

Examples to Help You Understand

- Example 1: Emily installs a solar system costing $23,000 that qualifies completely for the Residential Clean Energy Credit. She claims a tax credit of 30% × $23,000 = $6,900 when filing her federal return.

- Example 2: Kevin replaces his windows and exterior doors with ENERGY STAR® certified versions totaling $4,000 and installs energy-efficient insulation costing $3,000. Though 30% of $7,000 is $2,100, Kevin’s maximum credit is capped at $1,200 for these improvements for that tax year.

- Example 3: Rachel installs a geothermal heat pump and a 5 kWh energy storage system with combined costs of $24,000. She claims a $7,200 credit (30%) on her 2025 taxes.