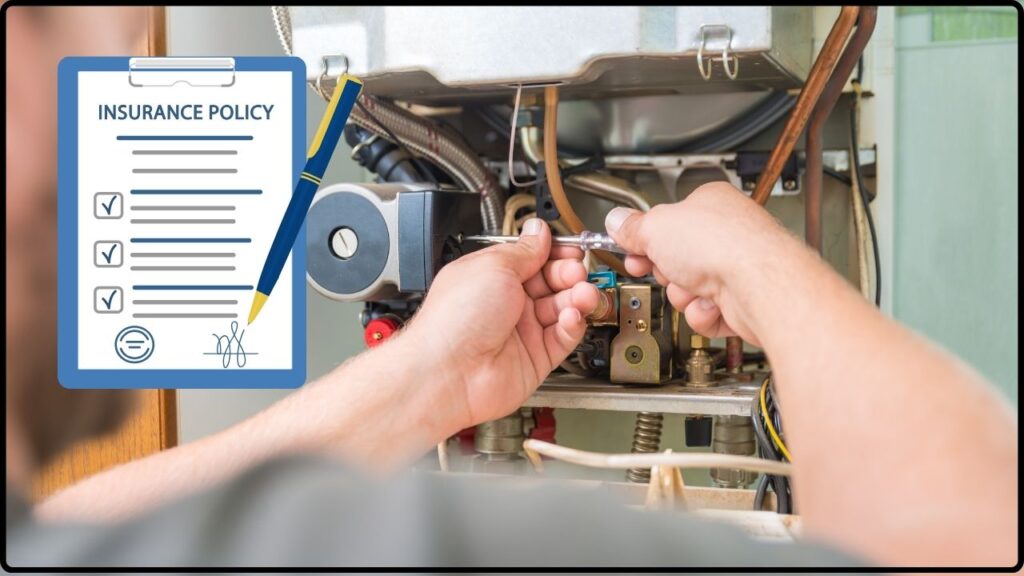

Does Homeowner’s Insurance Cover a Broken Furnace or Water Heater: When your furnace or water heater breaks down, it can turn your cozy home into a chilly and uncomfortable place, especially during the coldest months. The critical question many homeowners ask is: Does homeowner’s insurance cover a broken furnace or water heater? Understanding the nuances of coverage can save you from unexpected expenses and help you prepare better for repairs or replacements. Whether you’re a first-time homeowner, a landlord, or simply want to be informed, this article dives deep into the details, explaining what’s covered, what isn’t, and how you can safeguard yourself.

Table of Contents

Does Homeowner’s Insurance Cover a Broken Furnace or Water Heater

Homeowner’s insurance can cover damage to your furnace or water heater if caused by sudden, accidental perils like fire, storms, or bursting pipes. However, it does not cover damage from wear and tear, mechanical breakdowns, or lack of maintenance. To protect yourself, understand your policy, consider adding equipment breakdown coverage, maintain your appliances regularly, and document everything carefully. Armed with these insights, you can face furnace or water heater troubles confidently, knowing when to file claims and how to best safeguard your home and wallet.

| Aspect | Details |

|---|---|

| Coverage for Furnace or Boiler | Covered if damaged by fire, storm, lightning, falling trees; excludes wear and tear |

| Coverage for Water Heater | Water damage from sudden leaks usually covered; replacement generally excluded |

| Mechanical Breakdown Coverage | Not typically covered; may be included with Equipment Breakdown Endorsement |

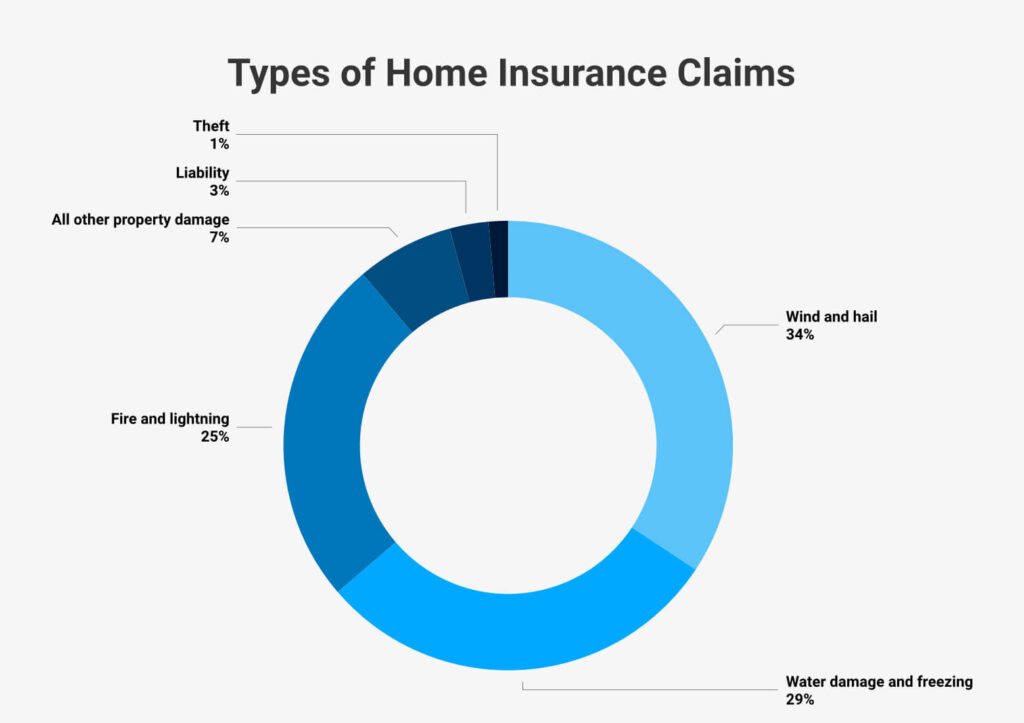

| Water Damage Claims | Water damage claims make up ~24% of all homeowner claims; average claim size around $12,500 |

| Home Warranty vs Insurance | Home warranties cover wear and tear; insurance covers sudden accidental damage |

| HVAC Maintenance | Regular inspections increase lifespan and support insurance claims |

| Loss of Use Coverage | Temporary living expenses covered if home becomes uninhabitable due to covered damage |

| Policy Review Importance | Understanding your specific policy’s exclusions and endorsements is critical |

| Official Resource | Insurance Information Institute |

Understanding What Homeowner’s Insurance Covers

Homeowner’s insurance is designed to protect your investment against unexpected and sudden losses—not the natural aging or slow deterioration of your furnace or water heater.

Furnace Coverage: What’s Included and What Isn’t?

Your furnace is your home’s heating engine, critical especially in northern states. Here’s a detailed breakdown:

- Covered Damage: If your furnace is damaged by covered perils—things like fire, lightning, hail, windstorms, falling trees, or a sudden burst pipe causing water damage—your insurance should cover repair or replacement costs. For example, if a tree crashes on your roof causing your furnace to be damaged by debris or water, the policy’s dwelling coverage kicks in.

- Excluded Damage: Damage from wear and tear, rust, corrosion, overheating, or electrical/mechanical failure that occurs over time is generally excluded. This means if your furnace fails because of poor maintenance, old age, or component failure (like a burnt-out motor), the insurance won’t cover it.

- Equipment Breakdown Endorsements: Many insurers offer optional coverage add-ons that specifically cover mechanical breakdowns and electrical failures, including for furnaces. Typically these endorsements require an additional premium but broaden your protection beyond standard policies.

- How to File a Claim: When filing, provide the make, model, and serial number of your furnace, detailed photos of damage, receipts of any maintenance, and documentation like police reports (if applicable). This documentation speeds up claim processing and supports your case.

Water Heater Coverage: More Than Just Hot Water

A sudden leak or burst from your water heater can cause significant damage to your home.

- Water Damage Coverage: Your homeowner’s insurance usually covers damage caused by sudden, accidental events like a water heater bursting or leaking unexpectedly. This means water damage to walls, flooring, and personal property caused by the leak is often covered.

- Replacement and Repair Exclusion: While water damage might be covered, repair or replacement of the water heater itself is typically excluded unless the damage was from a covered peril such as fire or storm damage. Wear and tear, rust buildup, or negligence-based failures are not covered.

- Maintenance Matters: Insurance companies expect homeowners to maintain their water heater. Lack of maintenance, sediment buildup, or failure to repair small leaks can lead to claim denial. Regular flushing and professional inspection can prevent unexpected failures and protect your claim.

- Rare Exceptions: Some policies treat water heaters as personal property, covering them for specific perils like theft or vandalism. Check your policy for such provisions.

Why Wear and Tear Is Always Excluded?

Think of your furnace and water heater as car parts—they need regular maintenance and replacement over time. Insurance is not designed to cover the gradual decline or mechanical aging of appliances. It’s intended for sudden, accidental damage. If your furnace or water heater breaks down due to normal use or neglect, insurance companies will likely deny claims on the basis of wear and tear.

Keeping detailed maintenance records is essential because it shows you cared for your equipment and differentiates proper upkeep from neglect.

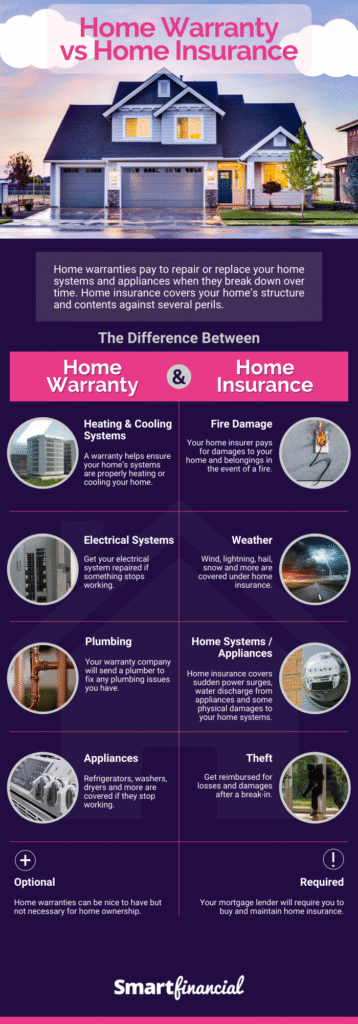

Home Warranty vs. Homeowner’s Insurance: What’s the Difference?

Many people confuse these two, but they serve distinct purposes:

- Homeowner’s Insurance: Protects your home and belongings from unexpected perils like fires, storms, or theft. It pays for damage caused by sudden events but not regular appliance breakdowns.

- Home Warranty: A service contract that covers repairs or replacements on home systems and appliances caused by normal wear and tear. If your furnace or water heater fails due to age or mechanical issues, a home warranty plan can cover those costs.

In essence, you want insurance for catastrophic events and a home warranty for everyday appliance breakdowns.

Practical Steps to Protect Your Heating Systems

1. Know Your Insurance Policy Inside Out

Every insurance policy has unique terms, coverage limits, and exclusions. Read your declarations page carefully, focusing on dwelling coverage, personal property, and any endorsements like equipment breakdown.

2. Consider Adding Equipment Breakdown Coverage

Adding this endorsement protects against mechanical failures, electrical surges, and pressure breakdowns that standard policies exclude. It’s an affordable option for peace of mind.

3. Keep Up the Maintenance

Schedule annual furnace inspections and flush your water heater regularly to prevent sediment buildup. Have HVAC specialists inspect, clean, and repair parts as needed. Maintaining your equipment not only prolongs life but also supports your insurance claims if damage occurs due to covered perils.

4. Document Damage and Repairs

If damage occurs, take detailed photos, keep repair receipts, and log service visits. Organized records help smooth the claims process and prevent claim denials based on negligence.

5. Understand Loss of Use Coverage

Many policies cover additional living expenses if your home becomes unlivable due to covered damage, such as a broken furnace in the middle of winter.

Real-Life Illustrations of Homeowner’s Insurance Cover a Broken Furnace or Water Heater

- In Boston, a sudden ice storm caused a power surge that damaged a homeowner’s furnace. Their policy’s equipment breakdown rider covered the replacement cost because the issue wasn’t normal wear and tear.

- A homeowner in Seattle had their furnace damaged by flooding caused by a burst pipe. Insurance covered both the furnace replacement and water damage repairs.

- In contrast, a homeowner in Phoenix who had a furnace breakdown due to lack of maintenance was denied a claim as the insurer cited mechanical failure from wear and tear.

- A water heater explosion in Chicago caused water damage to a basement. The insurer covered the water damage repair but not the replacement of the unit itself, highlighting the importance of additional coverage.

A Homeowner’s Guide to HVAC Financing: The Pros and Cons of Your Options

Personal Loan vs. Home Equity Loan (HELOC): What’s the Smartest Way to Fund a Renovation?

Is 0% APR HVAC Financing “Too Good to Be True”? A Financial Deep Dive