The 5 Hidden Costs of Homeownership: Buying a home is a big deal, y’all. It’s the classic American Dream—owning your own slice of the pie. But here’s a heads-up: the price tag goes way beyond the sticker price or monthly mortgage payment. The 5 hidden costs of homeownership can seriously shake your budget if you aren’t ready for them. So buckle up and read on because knowing these will help you budget smarter and keep that dream from turning into a financial nightmare.

Table of Contents

The 5 Hidden Costs of Homeownership

Owning a home in America today means more than just paying your mortgage. With hidden costs averaging over $21,000 a year, it’s critical to budget for maintenance, property taxes, insurance, utilities, and HOA fees. Taking the time to understand and prepare for these expenses will keep your financial stress low and your homeownership dream intact. Stay proactive, plan ahead, and enjoy your home without surprises.

| Hidden Cost Category | Average Annual Cost (2025) | Notes |

|---|---|---|

| Home Maintenance | $8,808 | Largest chunk of hidden costs; covers repairs, landscaping, pest control, and replacements |

| Property Taxes | $4,316 | Varies widely by state; New Jersey highest at $9,541 annually |

| Homeowners Insurance | $2,267 | Premiums vary by location and claims history |

| Utilities & Energy | $4,494 | Electricity, gas, water, trash, internet, cable |

| Internet and Cable | $1,515 | Separate from utilities, but necessary |

| HOA/Society Fees | Varies | For those in managed communities, includes amenities and maintenance fees |

Why The 5 Hidden Costs of Homeownership Matter?

The total cost of owning a house isn’t just what you pay the bank every month. In 2025, the average homeowner in the U.S. spends over $21,000 a year on expenses that most folks don’t expect—stuff like repairs, taxes, and utility bills. That’s some serious cheddar! These hidden costs often catch new homeowners off guard, leading to stress, debt, or worse—the dreaded forced sale.

The rising home prices and mortgage rates are pushing these costs even higher. As of April 2025, the median home price hit a near-record $437,942—a 44% jump since 2020—and mortgage rates have doubled in the last five years. That means new buyers are borrowing more money and paying more for it, increasing both monthly payments and the risk of surprise expenses.

But don’t sweat it. With some practical knowledge and solid budgeting, you can handle these costs like a pro. Let’s break down the five biggest hidden expenses and how to save smart.

1. Home Maintenance and Repairs: The Biggie You Can’t Ignore

No matter if you’ve got a brand-new place or something with character from the ’70s, repairs happen. It’s normal. And pricey. Maintenance costs average a whopping $8,808 per year nationwide. This covers everything from fixing a busted pipe, replacing an HVAC system, roof repairs, to routine landscaping and pest control.

Breaking Down Maintenance Costs

Maintenance isn’t just one big expense; it’s a bunch of smaller and sometimes big-ticket costs spread throughout the year. For example:

- Plumbing issues such as clogged drains or leaky faucets run from $150 to $450, while full replacements of bathtubs or bathtubs can spike between $1,500 and $8,800.

- HVAC maintenance, which includes seasonal tune-ups averaging about $150 to $250, filter replacements every 1-2 months at $20-$40, and full system replacements costing $7,000 to $12,000.

- Roof repairs range from minor leaks for $360 to complete roof replacements costing $5,800 to $13,000 depending on materials.

- Appliance repairs and replacements: Dryer repairs can cost $50 to $500, refrigerator repairs $50 to $800, and dishwasher replacements $370 to $3,500.

- Landscaping and pest control: Monthly lawn care can be $85-$150, irrigation system repairs $150-$400, and pest treatments vary depending on severity.

Why Maintenance Adds Up?

Older homes generally need more work, and delaying even minor repairs can snowball into costly emergencies. Regular upkeep extends your home’s lifespan and reduces the risk of surprise failures.

Pro Tip: Set aside 1-2% of your home’s market value each year for maintenance. For a $350,000 home, that means budgeting between $3,500 and $7,000 annually.

2. Property Taxes: A Heavy Annual Bill

You won’t escape property taxes no matter where you live in the U.S. They are annual charges based on your property’s value and local tax rates, which can increase as home prices rise.

The national average property tax bill tops $4,316 a year, but it ranges wildly:

- Highest: New Jersey homeowners pay an average of $9,541 annually.

- Moderate: States like California average about $7,000.

- Lowest: Southern and midwestern states often have property taxes well below national averages.

How Property Taxes Affect Your Budget?

These taxes can rise unexpectedly if the local government increases rates or your home undergoes reassessment. Because property tax is often rolled into monthly mortgage payments via escrow accounts, failing to budget for increases can hurt your finances.

Example: In some states, homeowners may face a sudden one-time reassessment after home improvements, instantly raising their tax bill.

Staying Ahead

Review your property tax notices each year and consult local tax assessors for exemptions or appeals, especially if you feel your home’s value has been over-assessed.

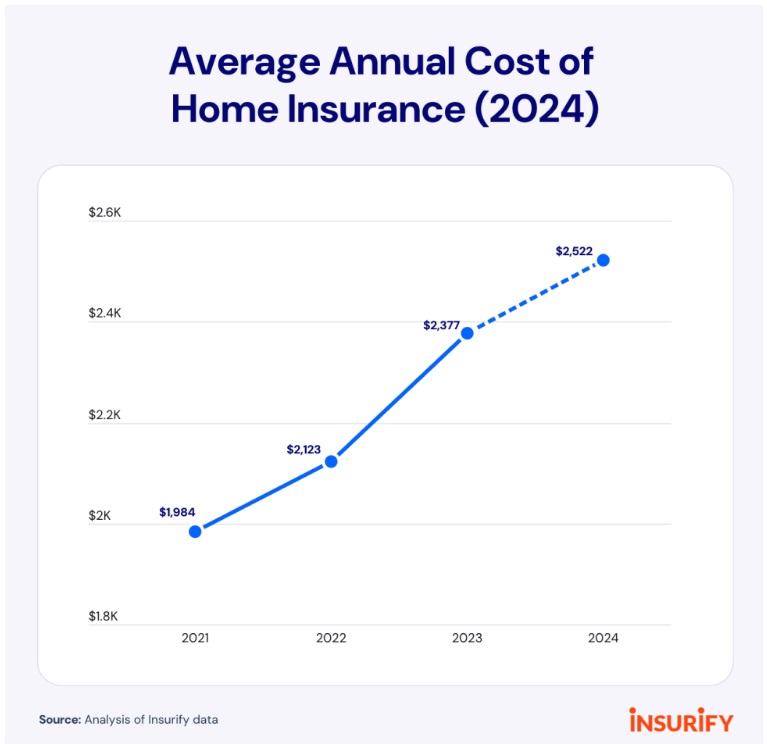

3. Homeowners Insurance: Protecting Your Investment (For a Price)

Homeowners insurance shields you from financial disaster if things go south—fire, theft, storms, or liability claims. The average U.S. homeowner pays about $2,267 per year for this coverage.

Factors Influencing Insurance Costs

- Location risk: Hurricane-prone Florida, fire-prone California, and flood zones will pay more.

- Claim history: Filing claims can spike your premiums.

- Coverage limits and deductibles: Higher coverage costs more but offers better protection.

- Home age and materials: Older or less safe materials can increase rates.

How to Manage Insurance Costs

- Shop around annually for the best rates—different insurers price risk differently.

- Bundle policies (auto, home, life) for discounts.

- Increase deductibles to lower premiums if you have a solid emergency fund.

- Invest in upgrades like storm-proof windows or security systems for discounts.

4. Utilities and Services: Monthly Bills that Add Up

Owning a home means paying for utilities—electric, water, gas, trash pickup, plus internet and cable services. The combined average annual cost is around $6,009, with utilities alone averaging $4,494 and internet/cable $1,515.

Why Utilities Can Be Surprise Expenses

Utility bills vary by climate, usage habits, and efficiency of appliances. Seasonal extremes can cause big spikes, such as high heating costs in winter or air conditioning in summer.

Trash and sewer fees may be bundled or charged separately, so homeowners should double-check municipal services.

Tips to Lower Bills

- Use energy-efficient appliances and LED bulbs.

- Install programmable thermostats.

- Fix leaks promptly to avoid water waste.

- Compare internet and cable packages yearly.

- Consider alternative energy sources, like solar panels, for long-term savings.

5. HOA Fees and Special Assessments: The Price of Amenities and Upkeep

Many neighborhoods or condo complexes have homeowners associations (HOAs) that charge fees to maintain shared facilities such as pools, landscaping, security, or clubhouses. These fees can range from a few hundred dollars annually to over $6,000 per year in luxury communities.

Special Assessments

HOAs can also levy special assessments for unexpected repairs—like repaving driveways, roof replacements on shared buildings, or emergency fixes. These can be large one-time costs that strike without warning.

What to Know Before Buying

- Review the HOA’s financial health and history of assessments.

- Understand rules regarding fee increases.

- Factor these fees into your monthly housing budget.

- Check what amenities and services are covered.

The Impact of Inflation and Rising Costs

Inflation affects everything from the cost of construction materials to labor expenses, pushing homeownership costs higher every year. Recent reports show material prices for repairs have risen by over 10% year-over-year, labor shortages pushing contractor fees, and insurance companies increasing premiums to keep pace with risk.

Planning for Inflation

Adjust your budget annually for inflation—making a habit of reviewing your costs every 6 to 12 months and updating your savings plan can prevent surprises.

Extra Costs to Watch Out For

Homeownership comes with some occasional but big-ticket additional expenses:

- Closing costs: Fees for appraisals, inspections, loan origination, title insurance typically equal 2-5% of the home price.

- Moving expenses: Hiring movers, utility setup fees, and purchasing new furniture can add up.

- Landscaping: Initial landscaping, seasonal planting, or irrigation system fixes can be pricey.

- Appliance upgrades: Refrigerators, washers, dryers don’t last forever—budget for replacements.

- Pest control: Termite treatments or rodent removal depending on your area might be necessary.

Tips for First-Time Homebuyers

- Get a thorough home inspection. Catch costly problems before you buy.

- Understand full cost implications. Property taxes, HOA fees, maintenance estimates, and insurance premiums all matter.

- Build an emergency fund to cover unexpected repairs.

- Shop around for services—insurance, utilities, internet—to find the best deals.

- Plan for inflation and future increases. Budget flexibly, not just for current costs.

Is 0% APR HVAC Financing “Too Good to Be True”? A Financial Deep Dive

A Homeowner’s Guide to HVAC Financing: The Pros and Cons of Your Options

Repair vs. Replace: A Financial Breakdown of an Aging AC Unit

How to Budget Smartly for Hidden Costs?

- Create an emergency fund starting at $1,000 and grow to cover 3-6 months of expenses.

- Set up sinking funds for property taxes, insurance, and maintenance.

- Schedule routine inspections to catch damage early.

- Review bills and service plans yearly.

- Know your HOA rules and fees before signing on.