Understanding “Green Loans”: Green loans are revolutionizing how American homeowners finance energy-efficient upgrades to their homes. They offer a powerful way to blend financial savvy with environmental responsibility. If you’ve been curious about what green loans are and how they can help you finance sustainable home improvements, this article is just the ticket. Broken down into clear, easy-to-follow sections, this guide blends approachable language with expert insights—perfect for homeowners, industry pros, and anyone in between.

Table of Contents

Understanding “Green Loans”

Green loans are transforming home financing by encouraging energy-efficient, sustainable upgrades with financial incentives that benefit both homeowners and the planet. Through lower interest rates, government credits, and expert support, green loans make eco-friendly living accessible and affordable. By following this comprehensive guide—from evaluating your home’s needs to managing your loan—you can invest in making your home smarter, greener, and more valuable. Going green isn’t just good for your wallet; it’s a vital step toward a cleaner future.

| Feature | Details |

|---|---|

| Loan Types | Unsecured green loans, green mortgages |

| Interest Rates | Typically 1-2% lower than traditional loans |

| Energy Savings | Up to 30% cut in utility bills |

| Eligible Projects | Solar panels, efficient HVAC, insulation, windows |

| Benefits | Lower bills, higher home value, tax credits |

| Eligibility Criteria | Credit score, income verification, energy audit |

| Professional Guidance | Available from loan officers and energy consultants |

What Are Green Loans?

At their core, green loans are financing products crafted exclusively to fund projects that improve energy efficiency and environmental performance in homes. Unlike traditional loans, green loans often come with lower interest rates, extended repayment terms, and access to federal or state incentives, all aimed at encouraging borrowers to invest in sustainable technologies.

Green loans may be:

- Unsecured consumer loans for smaller projects like purchasing solar water heaters or energy-efficient appliances.

- Green mortgages that offer either discounted rates or additional funds toward purchasing energy-efficient homes or retrofitting existing homes.

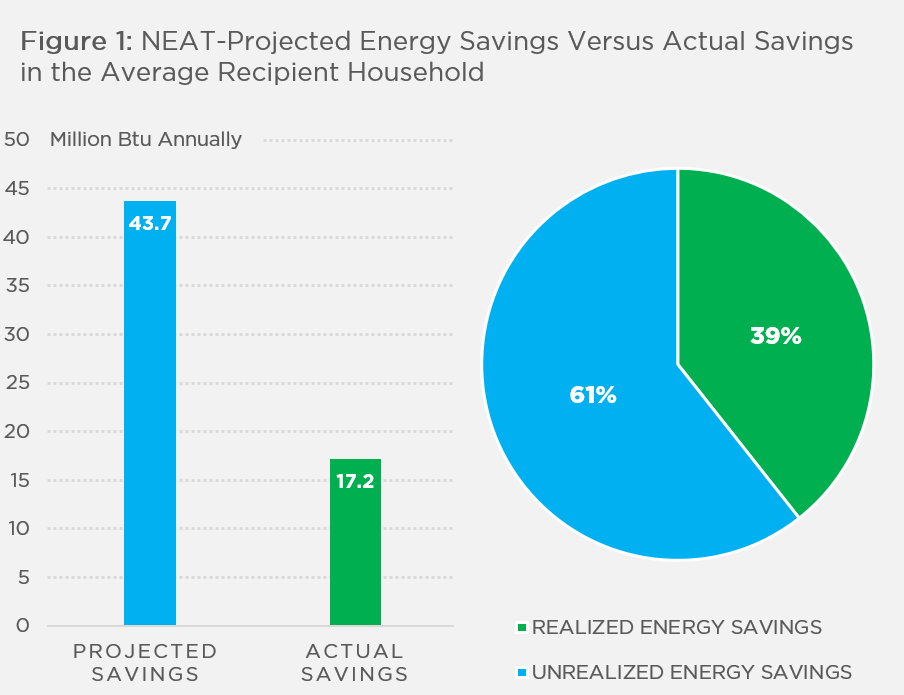

Per the U.S. Department of Energy, homes upgraded with energy-efficient technologies can cut utility bills by approximately 30%, making green loans an efficient means of financing that often pays for itself over time.

Lenders ranging from national banks to credit unions and online platforms now offer a variety of green loan products. The eligibility criteria typically include proof of homeownership, energy audit reports, and sometimes green certifications like ENERGY STAR or LEED.

Why Choose a Green Loan? Understanding the Benefits

You may ask yourself, “Why not pay cash or use a regular loan for these upgrades?” The green loan brings several compelling advantages that traditional loans don’t always offer:

- Lower Interest Rates: Lenders often provide rates that are 1-2% below conventional loan rates, making borrowing cheaper.

- Flexible Terms: Longer repayment terms reduce monthly payments, easing financial burdens.

- Government Incentives: Programs like the Federal Solar Investment Tax Credit can save you 26% on solar system installation costs.

- Enhanced Home Value: Energy-efficient upgrades often increase property resale values by 3-10%, according to the California Energy Commission..

- Lower Utility Bills: Energy-efficient technologies can cut your monthly energy consumption by up to 30%, directly affecting your pocket.

- Environmental Impact: Taking steps to reduce your carbon footprint contributes positively to combating climate change.

In addition, utilizing green loans positions you as an environmentally responsible homeowner, which has growing social and market value.

Green Loan Eligibility: What Do Lenders Look For?

Lenders assess several factors when deciding eligibility for green loans:

- Proof of Income and Financial Stability: Demonstrating steady, reliable income assures lenders you have the capacity to repay your loan.

- Creditworthiness: While most lenders require good credit scores, some programs cater to those with limited credit history by considering alternative data like timely utility bill payments.

- Home Energy Audit: Many lenders want proof that your upgrades will indeed make your home more energy-efficient. A professional energy audit provides this evidence.

- Project Certification: Eligible upgrades typically require certifications such as ENERGY STAR or LEED compliance.

- Required Documentation: This usually includes identification, proof of homeownership, contractor invoices, and detailed project proposals.

For first-time borrowers or those with less-than-perfect credit, options exist, often involving co-signers or lower loan amounts.

Step-by-Step Guide to Applying for a Green Loan

Step 1: Evaluate Your Home’s Efficiency Needs

Before anything else, assess which parts of your home could benefit most from an upgrade. Tools like the U.S. Department of Housing and Urban Development’s Home Energy Score provide clear insights into energy performance and identify key areas for improvement

Step 2: Explore Green Loan Options

Research banks, credit unions, and online lenders that offer green financing. Take note of interest rates, benefits, eligibility requirements, and applicability to your specific upgrades.

Step 3: Obtain a Professional Energy Audit

An energy audit conducted by a certified professional will evaluate your home’s current condition and recommend efficient upgrades. Some lenders require this to approve loans.

Step 4: Compile Necessary Documentation

Gather your financial statements, proof of homeownership, audit reports, estimates from contractors, and any certification related to your project.

Step 5: Apply for the Loan and Await Approval

Submit your application and respond to any additional queries from the lender. Pre-approval can speed up the process.

Step 6: Implement Your Upgrades

Use the loan funds to complete your eco-friendly home improvements, ensuring all work complies with loan and energy certification requirements.

Step 7: Track Your Savings and Benefits

Monitor your monthly bills to measure reductions in energy consumption, validating your investment in energy efficiency.

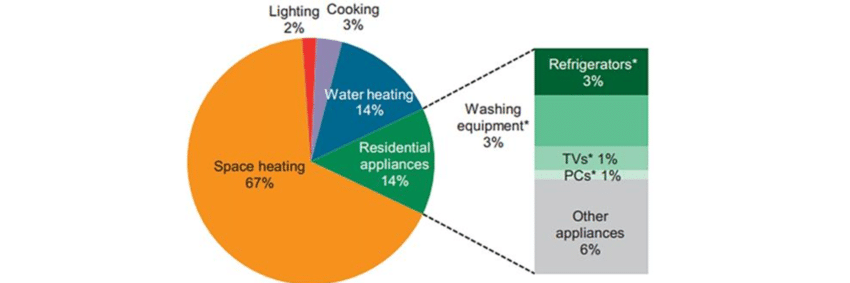

Types of Energy-Efficient Upgrades Eligible for Green Loans

The spectrum of improvements financed by green loans includes:

- Solar Power Systems and Battery Storage: Produce renewable energy and maintain power reliability during outages.

- Insulation and Sealing: Improve thermal efficiency by reducing drafts and heat loss.

- High-Efficiency HVAC Systems: Upgrade to models that consume less energy and maintain comfort.

- Smart Thermostats and Controls: Automate energy settings for optimal savings.

- Energy-Efficient Windows and Doors: Use double or triple-pane glass to conserve heat and coolness.

- LED Lighting and ENERGY STAR Appliances: Significantly reduce electricity use with advanced lighting and equipment.

- Water Conservation Systems: Install low-flow toilets, faucets, and irrigation that reduce water usage.

- Rainwater Collection and Green Roofs: Sustainably manage water runoff and enhance insulation.

Each upgrade offers specific benefits and return-on-investment timeframes, with some paying for themselves within a few years.

Managing and Maximizing Your Green Loan

To get the most out of a green loan, consider these best practices:

Understand Loan Terms Fully

Be aware of details like:

- Prepayment Penalties: Can you pay off early without additional fees?

- Disbursement Schedules: Are funds released upfront or after project completion?

- Certification Compliance: Does your loan require ongoing reporting on environmental benefits?

Combine Incentives

Stack your green loan with federal and state tax credits, rebates, and utility company programs for maximum savings. For example:

- The Federal Solar Investment Tax Credit (ITC)

- State and local energy efficiency rebate programs

- Utility company energy-saving rebates

Keep Meticulous Records

Maintain documentation that includes contracts, receipts, certifications, and energy savings data for tax benefits and warranty claims.

Plan Your Investment for Best ROI

Focus on upgrades with quicker payback periods, like LED lighting and smart thermostats, alongside long-term investments like solar panels.

A Homeowner’s Guide to HVAC Financing: The Pros and Cons of Your Options