5 Financial Goals Every Homeowner Should Set: Owning a home is more than just having a place to live—it’s one of the most significant investments you’ll make and a lifelong commitment to managing your finances well. For homeowners in 2025, setting clear financial goals is the ultimate way to protect your investment, avoid surprises, and build wealth smartly. This comprehensive guide lays out 5 key financial goals every homeowner should set this year, explained in plain language that’s easy to grasp but rich with professional insight and actionable tips.

Table of Contents

5 Financial Goals Every Homeowner Should Set

Homeownership is rewarding but comes with complexities that require solid financial planning. Setting clear goals—building an emergency fund, paying down expensive debt, budgeting for upkeep, saving for upgrades, protecting your home, and leveraging tax benefits—provides a roadmap to financial wellness and peace of mind in 2025. Start small, keep consistent, and watch your home and finances thrive together.

| Goal | Description | Tips & Stats |

|---|---|---|

| Emergency Fund | Save 3-6 months of living expenses to cover unexpected costs | Crucial for repairs, job loss, and medical expenses |

| Pay Off High-Interest Debt | Prioritize credit cards and personal loans | Improves credit and frees cash flow |

| Budget for Maintenance | Allocate 1-3% of your home’s value annually | Prevents costly emergency fixes |

| Make a Stick-to Budget | Use the 50/30/20 rule for needs, wants, and savings | Balanced approach to spending |

| Save for Future Upgrades | Establish sinking funds to avoid loans | Builds funds steadily for renovations |

| Protect with Insurance | Get adequate homeowners insurance coverage | Protects against disaster and liability |

| Leverage Tax Benefits | Use mortgage interest & property tax deductions | Can reduce tax liability significantly |

Why Financial Goals Matter for Homeowners in 2025?

Owning a home means balancing mortgage payments, upkeep, unexpected repairs, and lifestyle costs. Without clear financial goals, it’s easy to get overwhelmed or fall behind. Planning ahead helps homeowners avoid debt, benefit from tax perks, maintain their property’s value, and secure their family’s future. Goals provide a roadmap for spending smart, saving effectively, and staying financially stress-free.

5 Financial Goals Every Homeowner Should Set

1. Build or Strengthen Your Emergency Fund

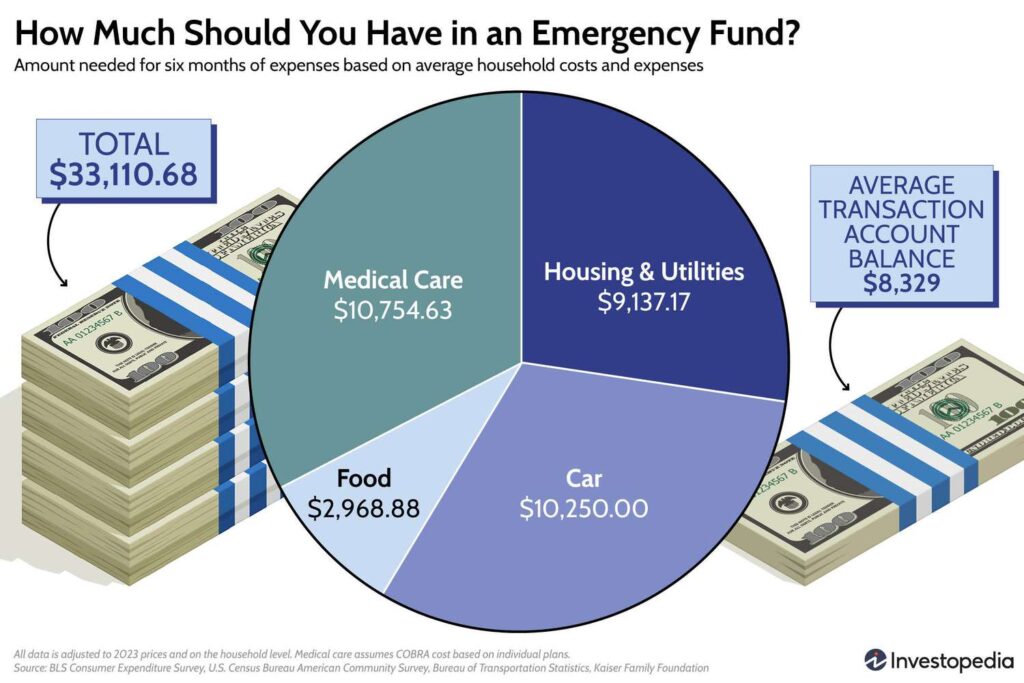

An emergency fund is your financial lifeline when life throws unexpected challenges your way—like a broken furnace or a sudden medical bill. Experts recommend saving enough to cover 3 to 6 months of essential expenses—including mortgage, utilities, groceries, and transport. This fund reduces dependence on high-interest credit and helps you stay stable during tough times.

How to Build It:

- Start Small & Be Consistent: Even saving $25 or $50 per week adds up quickly. Consistency beats trying to save large amounts irregularly.

- Automate Savings: Set up automatic monthly transfers to a dedicated savings account. This “out of sight, out of mind” method creates a reliable saving habit.

- Use Windfalls Wisely: Tax refunds, bonuses, or side income can jumpstart or boost your fund.

- Adjust Goals as Needed: Life changes like adding a family member or moving require tweaking savings targets.

Why It Matters:

A survey found only 44% of Americans can cover a $1,000 emergency right away, showing many are financially vulnerable [morganstanley.com]. Building this fund means fewer sleepless nights when the unexpected happens.

2. Pay Down High-Interest Debt

High-interest debts like credit cards or payday loans drain your finances faster than most other expenses. While paying your mortgage is critical, clearing these debts first frees up monthly cash flow and improves your credit score. This means better loan terms in the future and less stress.

Tips to Tackle Debt:

- Avalanche Method: Pay off debts with the highest interest rates first while making minimum payments on others.

- Consolidate Loans: If possible, refinance or consolidate high-interest debt into lower-rate options.

- Avoid New Debt: Resist taking on more credit while paying off existing debt.

With interest rates currently fluctuating, reducing these debts is a smart priority to maintain financial flexibility and stability.

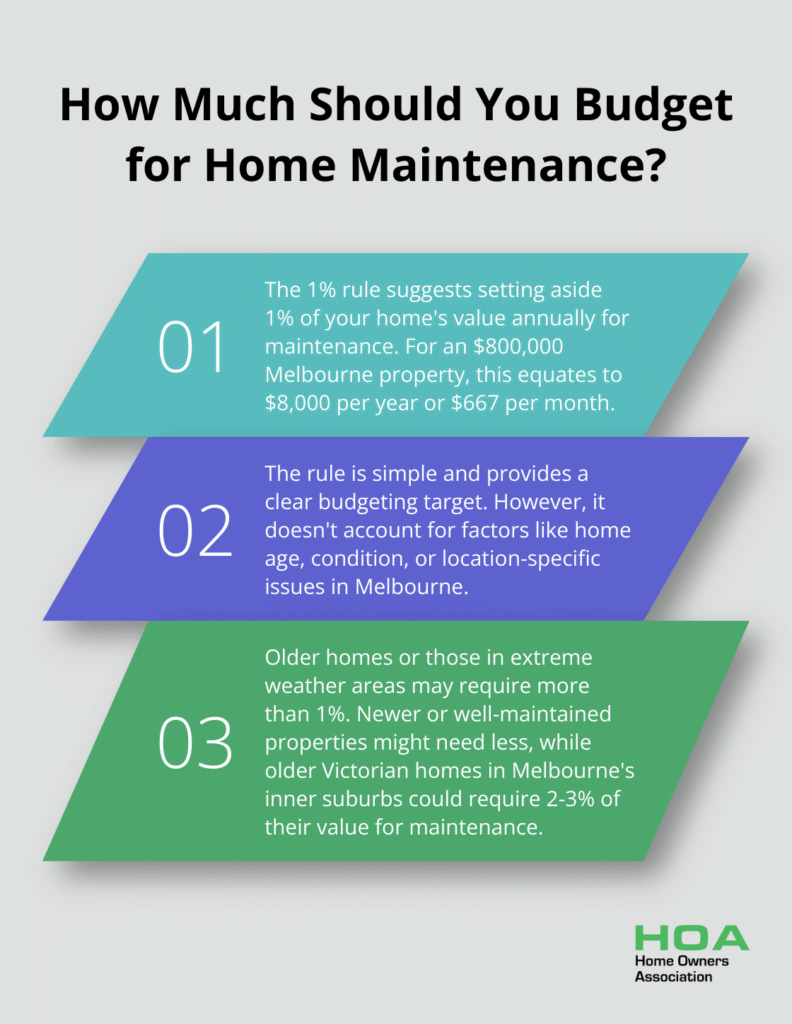

3. Budget for Home Maintenance and Repairs

Home maintenance costs add up fast, but neglecting them can result in expensive emergency repairs and devaluation. A good rule is to save 1 to 3% of your home’s market value each year specifically for upkeep.

What to Budget For:

- Seasonal HVAC servicing and filter replacements

- Roof inspections and minor repairs

- Plumbing fixes and water heater maintenance

- Lawn care and pest control

- Appliance replacement or repair

Example: On a $350,000 home, budgeting $3,500 to $10,500 annually ensures you’re prepared for these costs.

Pro Tips:

- Schedule Regular Inspections: Catch issues early before they become costly.

- Keep a Maintenance Calendar: Track upkeep tasks seasonally.

- Prioritize Repairs: Address safety-related and structural issues first.

Staying ahead saves money and keeps your home comfortable and marketable.

4. Create and Stick to a Realistic Budget

A well-structured budget is the foundation of all smart homeownership goals. The popular 50/30/20 rule breaks your income down into manageable categories:

- 50% Needs: Mortgage, utilities, insurance, groceries.

- 30% Wants: Dining out, entertainment, vacations.

- 20% Savings & Debt Payments: Emergency fund, retirement, extra mortgage payments.

Practical Advice:

- Use budgeting apps like Mint or You Need a Budget for real-time tracking.

- Review your spending monthly to catch any leaks.

- Adjust as life changes—pay raises, kids, or relocation affect your budget needs.

Having a budget means no surprises and better control over where your money goes.

5. Save for Future Home Improvements and Major Purchases

Big projects like a kitchen renovation or a new vehicle are exciting but costly. Financing them through credit cards or loans can lead to high interest costs. The solution is to set up a sinking fund—a dedicated savings account where you contribute regularly toward your next big purchase.

How to Start:

- Set a target amount and timeline (e.g., $6,000 in 12 months).

- Divide the total by months and deposit that amount monthly (e.g., $500/month).

- Adjust contributions if monthly budgets fluctuate.

Consistency pays off, giving you the ability to improve your home without going into debt.

6. Protect Your Home with Adequate Insurance

Homeowners insurance is critical protection, covering losses from fire, theft, natural disasters, and liability claims. Mortgage lenders typically require it, but its value goes beyond that.

What Insurance Covers:

- Structural damage to your home.

- Personal possessions inside your home.

- Liability for accidents occurring on your property.

- Additional living expenses if your home is temporarily uninhabitable.

Tips:

- Review your policy annually to ensure coverage matches your home’s current value.

- Consider bundling with auto insurance for discounts.

- Add riders for expensive items like jewelry or artwork.

Proper insurance safeguards your biggest asset from financial devastation.

7. Take Advantage of Homeowner Tax Benefits

Owning a home offers significant tax perks that many overlook. In 2025, new laws allow for tax relief on two self-occupied properties, a major benefit for those who own more than one home.

Common Tax Benefits:

- Mortgage interest deduction on primary and secondary homes.

- Property tax deductions.

- Energy efficiency credits for upgrades like solar panels or insulation.

Staying informed on tax regulations and consulting a pro ensures you maximize your returns and minimize your tax liability.

8. Monitor Credit and Consider Refinancing

A strong credit score is your best tool for accessing favorable mortgage rates and refinancing options, which can reduce monthly payments or overall interest.

Best Practices:

- Check your credit report annually for errors.

- Pay bills on time consistently.

- Reduce credit card balances.

- Avoid opening new credit lines before refinancing.

Refinancing at the right time could save thousands over your loan’s life.

9. Prepare for Property Taxes and Other Ongoing Costs

Property taxes can unpredictably rise based on local assessments. Plan ahead by budgeting for potential hikes and setting up escrow accounts if your lender offers it.

Additional Ongoing Costs:

- Homeowner association (HOA) fees.

- Utilities and seasonal increases.

- Waste disposal or ramp-up in maintenance costs.

Awareness here prevents budget surprises and helps you maintain financial balance.

Understanding “Green Loans”: Financing for Energy-Efficient Home Upgrades

The 5 Hidden Costs of Homeownership (And How to Budget for Them)

How to “Pay Yourself First” to Build a Home Repair *and* a Retirement Fund