5 Credit Score Mistakes to Avoid: When it comes to financing a home repair, your credit score isn’t just a number — it’s the golden ticket that can unlock low interest rates, manageable payments, and loan approval. But plenty of folks get tripped up by common credit score mistakes that can tank their chances or hike up their borrowing costs. Whether you’re patching a leaky roof or renovating your kitchen, knowing what to avoid can save you serious cash and hassle down the line. In this article, we’ll break down five credit score mistakes to dodge when financing those home repairs. We’ll keep it easy-peasy with real-world examples and practical tips designed tanto for everyday homeowners as well as pros in the finance or real estate game. By the end, you’ll have a clear roadmap to protect your credit and get your home fixed up without breaking the bank.

Table of Contents

5 Credit Score Mistakes to Avoid

Avoiding these five credit score mistakes—failing to check your score, missing payments, high credit utilization, multiple loan inquiries, and ignoring DTI—is vital when financing your home repair. Armed with this knowledge, take proactive steps to improve your credit, explore suitable loan options, and prepare thoroughly for your application to ensure affordable financing and a smooth repair journey. Keep your credit in top shape, save smartly, and get your home projects done without financial headaches.

| Key Point | Details |

|---|---|

| Minimum credit score for home repair loans | Usually 650+ for favorable terms |

| Impact of missed payments | Lowers credit score significantly |

| Recommended credit card utilization | Keep below 35% of credit limits |

| Effect of multiple loan applications | Lowers credit score due to hard inquiries |

| Debt-to-income ratio importance | Critical for lender approval |

| Home improvement projects average cost when financed by home equity | $10,622, over five times larger than unsecured loan financed projects |

Why Your Credit Score Matters for Home Repair Loans?

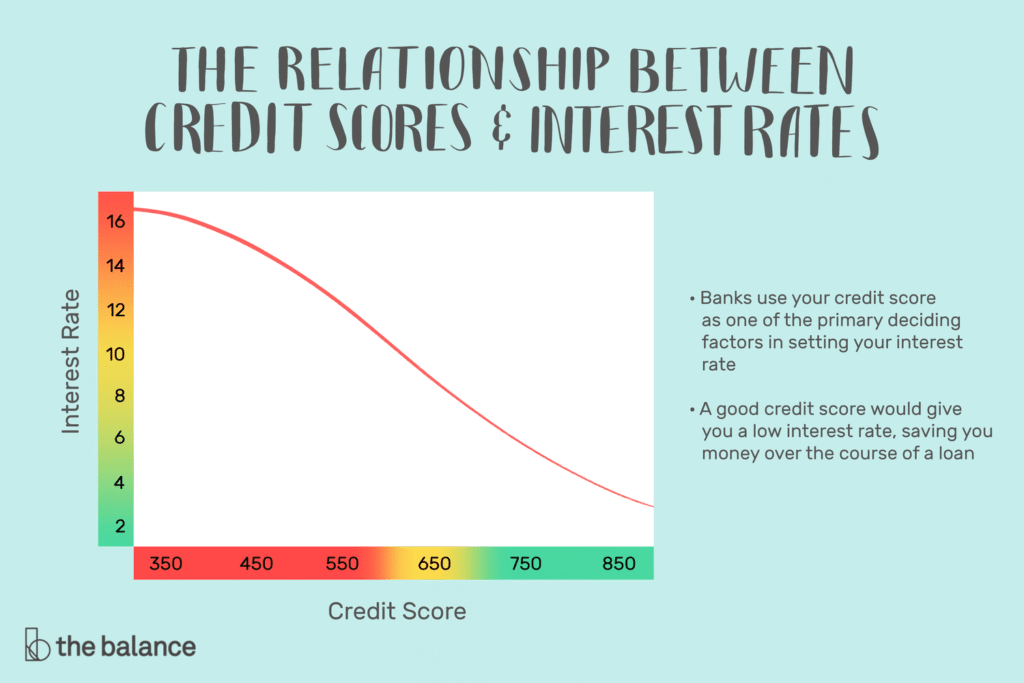

Your credit score is like your financial report card to lenders, showing how reliable you are with borrowing and making payments. When you’re financing a home repair, lenders carefully examine this score to decide if you qualify for a loan and what interest rate you’ll pay. The higher your score, the better your chances and more favorable the terms.

To put this in perspective, let’s say you’re financing a $10,000 loan to replace your HVAC system. With a strong credit score, you might secure a loan with a 5% interest rate, keeping your monthly payments reasonable and total interest low. Conversely, a lower credit score could push your interest rate into the double digits—sometimes 12-15% or more—adding hundreds of dollars in interest over the life of the loan.

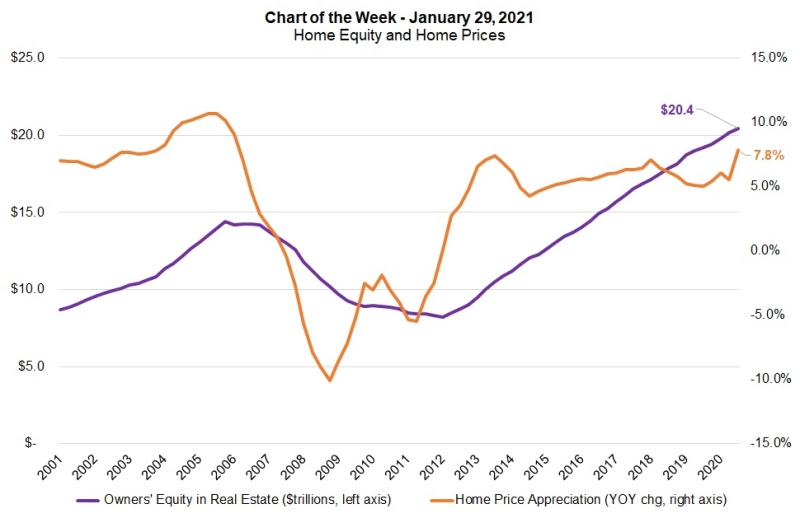

Moreover, data from the Joint Center for Housing Studies at Harvard University reveals that home improvement projects financed through home equity lines or loans average $10,622—more than five times larger than those financed through unsecured personal loans or credit cards. This demonstrates how crucial it is to have good credit to access larger sums at affordable rates when tackling major repairs or remodels.

Top 5 Credit Score Mistakes to Avoid

1. Not Checking Your Credit Score in Advance

One of the most common mistakes is diving into loan applications without first checking your credit score. This is like arriving for a job interview blindfolded—you don’t know what to expect, and you can’t prepare properly.

If your credit score falls below the lender’s minimum threshold, often around 650, your loan application might be denied outright or approved only at higher interest rates. Hidden errors or outdated information on your credit report can also drag your score down unnoticed.

Practical tip: Pull your credit reports from the three major bureaus—Equifax, Experian, and TransUnion—at least three months before applying. AnnualCreditReport.com offers free access once a year. Review them carefully for any inaccuracies such as incorrect accounts, late payments that were actually paid on time, or fraudulent activity. Dispute any issues promptly, as correcting errors can sometimes bump your score quickly.

Planning ahead gives you time to improve your credit through responsible payments, reducing balances, and limiting new credit inquiries before applying.

2. Missing Payments or Paying Late

Your payment history composes approximately 35% of your credit score calculation—making it the single most important factor. Missing or late payments on any credit account, including credit cards, personal loans, or even utility bills in some cases, send a strong negative signal to lenders.

Even a single missed payment can cause your credit score to drop by 50 to 100 points, or more depending on your overall credit profile. This can translate into loan denials or higher borrowing costs.

Imagine treating your bills like deadlines for work—consistently late submissions jeopardize trust. Lenders see late payments the same way.

Practical tip: Set up automatic payments or use calendar reminders to keep track of due dates. If life throws a curveball and you miss a payment, pay it as soon as possible. Contact your lender and ask for goodwill adjustments or potential waivers of late fees; sometimes they’re willing to help if this is a rare occurrence.

Consistently meeting payment deadlines gradually rebuilds and strengthens your creditworthiness.

3. Using Too Much of Your Available Credit

Your credit utilization ratio (the percentage of your credit card limit you are currently using) comprises around 30% of your credit score. The rule of thumb is to keep it below 30-35% to avoid triggering lender concerns.

If you max out your credit cards or have high balances relative to your credit limits, lenders interpret this as a warning sign of financial stress—potentially limiting your loan options or increasing interest rates.

For example, if you have a $5,000 credit limit and your balance is $4,000, you are utilizing 80% of your credit, which can significantly lower your score.

Practical tip: Aim to pay down credit card balances well before applying for a repair loan. If you can’t pay in full, try to keep balances low on all cards and avoid opening new credit cards, which initially increases your utilization ratio.

Some borrowers also benefit from requesting credit limit increases (without increasing spending) to reduce utilization ratios and improve scores.

4. Applying for Multiple Loans or Credit at Once

Every loan or credit card application results in a hard inquiry on your credit report. Multiple inquiries within a short time frame can signal desperation or higher risk to lenders.

Imagine you’re comparison shopping for a new car and apply for five different loans in a month. While this might seem smart shopping to you, lenders view multiple inquiries as potential financial instability.

Frequent hard inquiries can reduce your credit score by 5-10 points each and might lead lenders to deny or charge more on your home repair financing.

Practical tip: If shopping for rates, do it all within a 14- to 30-day window. Most credit scoring models recognize rate shopping and count multiple inquiries in that window as one.

Avoid applying for any new credit accounts or loans immediately prior to applying for your repair loan to reduce inquiry hits.

5. Ignoring Debt-to-Income Ratios and Income Verification

Beyond just your credit score, lenders analyze your debt-to-income ratio (DTI), which compares how much debt you carry against your gross monthly income. An excessive DTI suggests you might struggle to manage additional loan payments.

For example, if your monthly gross income is $5,000 but you already have $3,000 in debt payments, your DTI is 60%, which is considered very high by most lenders. Many lenders prefer DTIs below 43%, and lower is always better.

Your income is also verified through proof such as pay stubs, bank statements, or tax returns. Unstable or irregular income can reduce your chances of loan approval even if your credit score is strong.

Practical tip: Maintain monthly debt payments below 36-40% of your income for best loan eligibility. Before applying, document your income sources and create a budget to reduce unnecessary debt.

Improving DTI might involve paying off high-interest debts or consolidating loans into a manageable payment.

Additional Insights on Financing Home Repairs

How Credit Scores Influence Loan Approval and Terms

Lenders usually require a minimum credit score of around 680 for home repair or improvement loans. Scores above 760 typically secure the best interest rates and loan flexibility. Lower scores (620-679) might get approved, but borrowers often face higher interest rates, fees, and shorter repayment periods.

Terms can vary significantly; a few percentage points difference in interest rate can mean thousands saved over a 10-year loan. Also, borrowers with scores below 620 may find approval very difficult, requiring cosigners or collateral.

Loan Options for Home Repairs

- Personal loans: Generally unsecured, interest rates depend heavily on credit score. Good for smaller repairs or when you do not want to tap home equity.

- Home equity loans/HELOCs: Secured by your home, often lower rates but risking your home if payments aren’t made. Usually require a credit score above 680 and substantial home equity.

- Government loans: FHA 203(k) loans allow financing renovations with credit scores as low as 620 and offer government backing.

- Credit cards: Can be useful for small urgent repairs, especially with 0% introductory APR offers, but carry higher interest afterward.

Understanding each option’s credit score requirements and risks helps you choose wisely.

Building an Emergency Fund & Credit Monitoring

Cultivating an emergency savings fund to cover unexpected repairs helps minimize loan dependence and protect credit. Experts recommend saving 3-6 months’ expenses.

Regular credit monitoring via free services can alert you to negative changes or fraud, allowing timely correction before applying for loans.

Contractor’s Role in Financing

Contractors knowledgeable about financing can guide you on improving credit scores, assembling documentation, and selecting the best loan products, smoothing your path to project completion without surprise financial hurdles.

Personal Loan vs. Home Equity Loan (HELOC): What’s the Smartest Way to Fund a Renovation?

Understanding “Green Loans”: Financing for Energy-Efficient Home Upgrades

A Homeowner’s Guide to HVAC Financing: The Pros and Cons of Your Options